Introduction

When discussing the modernisation of the EU VAT system, often reverse charge is mentioned as a solution to tackle VAT fraud and close the VAT gap. In the following we will provide an introduction to the reverse charge mechanism, explain why it is actually not the best tool to fight VAT fraud and discuss how reverse charge can co-exist with real-time reporting systems such as summitto’s solution.

What is reverse charge?

In 2007 the European Commission launched a public consultation regarding the feasibility of reverse charge in relation to combatting VAT fraud.[1] As a result, in certain instances EU Member States are now allowed to apply the reverse charge mechanism following Article 199 of the VAT Directive.[2] When reverse charge is applied, not the supplier, but the buyer is liable for reporting the VAT to the tax authority. It “was introduced with the aim to tackle the risk of ‘missing trader fraud’ in such cases where the supplier avoids to pay the VAT from sales and where at the same time the customer has the right to deduct the input VAT” as the Czech proposal for a Generalised Reverse Charge Mechanism (GRCM, so reverse charge applied to the entire economy) to the EC states. Before exploring if reverse charge is actually achieving this goal, let’s first have a look at reverse charge in practice.

Let’s say Company A is supplying goods under the reverse charge mechanism to Company B. In this case, Company A sends the invoice without VAT (as it is reversely charged) to Company B with a reference to the fact that reverse charge is applied. As not the supplier, but the buyer is liable for VAT, the latter will report this on its VAT return. Company B will calculate how much VAT it would have to pay if the reverse charge mechanism was not applied. This is then reported both under the sales section (input VAT) as under the purchase section (output VAT).[3] So, no VAT is charged nor paid to the tax authority. VAT is charged when the reverse charge mechanism does not apply to the next transaction in the value chain, or all the way at the end of the value chain, when goods are sold with VAT to the end consumer. A similar mechanism is applied to intra-Community transactions.

The proposal of the Czech Republic to introduce a GRCM, was in the end not adopted. Although there is currently the possibility to acquire a derogation from the VAT Directive in order to introduce a GRCM, it can only be done “under very strict technical conditions” and is not applied in any EU Member State at the moment of writing.[4] One of the reasons for these strict technical conditions seems to be that it does not sufficiently tackle VAT fraud.

| What is the difference between 0% VAT and a VAT exemption |

|---|

| There is a difference between 0% VAT and an exemption. In case a 0% rate applies, no VAT needs to be reported on the VAT return. It also means that input VAT can be deducted. For exempted goods and services, the “hidden VAT” (if there is any) needs to be reported on the VAT return as was explained under “What is reverse charge”. However, there are two categories of exemptions. First, there are exemptions without the right to deduct, such as financial and insurance services.[5] Second, there are exemptions with the right to deduct. Examples are intra-Community transactions[6] and reverse charge transactions.[7] |

Does reverse charge tackle VAT fraud?

It’s true that reverse charge makes current VAT fraud schemes, such as MTIC fraud, very hard to execute.[8] However, when it’s applied to only certain sectors, fraudsters can quite easily move to other sectors to apply their fraud schemes. On the other hand, when applied in a generalised manner, it effectively creates a sales tax system, which comes with many other problems. The distributed responsibility to pay VAT throughout the value chain is then lost, because with reversed charge only the last company in the value chain is responsible to pay VAT. As Professor of Tax Law at the University of Groningen, Redmar Wolf, argues this would “result in different types of fraud.” The potential fraud will then occur at the retail stage, amassing a higher amount of VAT then in the current system where VAT is evenly distributed. This might make fraud even more lucrative than it is now. Additionally, a GRCM would overhaul the entire VAT system, resulting in enormous administrative costs.[9] Costs that might not even result in actual benefits.

In short, although reverse charge could help to tackle MTIC fraud in the short run, it comes with different problems that might even prove to be more difficult to solve than the initial MTIC fraud. As we have explained quite often, real-time reporting is a more efficient tool to actually reduce the VAT gap and modernise the EU VAT system. The increased implementation of this tool throughout the EU proves that many EU Member States agree. The question that remains: can real-time reporting coexist with existing reverse charge regulations?

Reverse charge in an EU Member State with a real-time reporting system

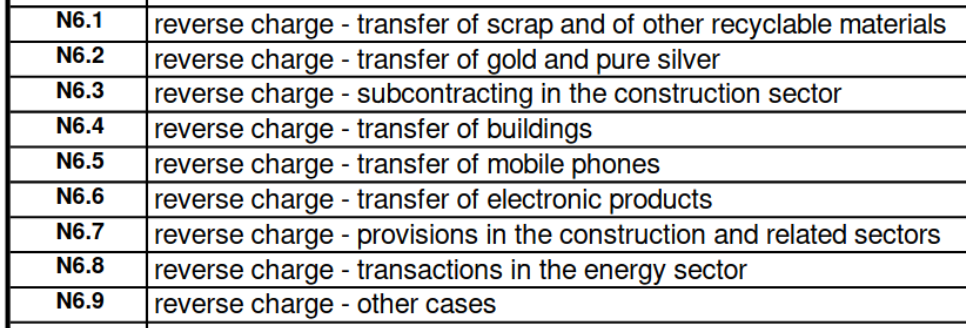

In Italy both real-time reporting (Sistema di Interscambio - SdI) and reverse charge (in certain sectors) are implemented and therefore can serve as a perfect use-case to demonstrate how both can co-exist. Remarkably, Italy is using the reverse charge mechanism less than other EU Member States which might imply a reduced need resulting from the implementation of real-time reporting.[10] Still, there are several sectors/categories of transactions to which a reverse charge applies. The “transfer of mobile phones” is one of these categories.[11] In case such a transaction takes place, the supplier needs to add the code N6.5 under the field

This is a simple and efficient way to let both solutions co-exist and shows that it is not necessary to change the entire reverse charge legislation in case an EU Member States wants to implement real-time reporting.

Figure 1: Reverse charge via the Italian SdI

Source: FatturaPA (2021)

Is it feasible to implement both real-time reporting and reverse charge?

As reverse charge is still sometimes part of the discussions regarding tackling VAT fraud, it is relevant to answer the question: is it feasible to implement both real-time reporting and reverse charge?

First of all, a GRCM does not have a very strong theoretical and political support, as was already confirmed by the refusal of such a proposal by the EU Member States. A reverse charge for specific sectors might help to tackle specific types of VAT fraud (e.g. MTIC fraud) and could therefore be beneficial in certain sectors. However, reverse charge seems to be less effective in tackling VAT fraud, because of the reasons mentioned above, than real-time reporting. So opting for reverse charge with the aim to tackle fraud might not be the most efficient solution.

However, a combination of both solutions could create the optimal VAT system. As discussed above, the biggest problem of a GRCM is that the possibility to track VAT throughout the value chain is lost. Real-time reporting can solve this problem. It allows the tax authority to instead of tracking the VAT money, to track the invoices reported by the taxpayer. It can even be argued that because reverse charge removes the VAT payments from the value chain, it even makes it more difficult for fraudsters to set up fraudulent schemes.

All in all, in case the aim of a Member State is to tackle VAT fraud, reverse charge alone seems not to be the best solution. In order to achieve this goal, it is recommended to focus on real-time reporting. Still, a combination of both could offer additional benefits, making it even more complicated for the ill intended to defraud the system.

Summitto’s real-time reporting solution and reverse charge

Just as in the example of the Italian SdI system, summitto’s real-time reporting solution also allows for the implementation of reverse charge. This can be solved in a similar manner, depending on legislation, by mentioning on the invoice information reported to the tax authority that reverse charge applies.

In case you want to know more about our real-time reporting solution have a look at our website at www.summitto.com or do not hesitate to contact us at info@summitto.com

[1] https://ec.europa.eu/taxation_customs/vat-optional-reverse-charge-mechanism_en

[2] https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32006L0112&from=EN

[3] https://ec.europa.eu/taxation_customs/system/files/2018-01/split_payment_report2017_en.pdf

[4] https://www.consilium.europa.eu/en/policies/vat-reverse-charge/

[5] https://ec.europa.eu/taxation_customs/exemptions-without-right-deduct_en

[6] https://ec.europa.eu/taxation_customs/exemptions-right-deduct_en

[8] https://ieb.ub.edu/wp-content/uploads/2021/05/WSTAX2021_Tassi.pdf

[9] https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.902.8872&rep=rep1&type=pdf

[10] https://www.avalara.com/vatlive/en/country-guides/europe/italy/italian-vat-reverse-charge.html

[11] https://www.fatturapa.gov.it/export/documenti/fatturapa/v1.2.1/Table-view-B2B-Ordinary-invoice.pdf