Introduction

Recently the European Commission published the long awaited VAT in the Digital Age report. In the following we will discuss and analyse the central finding of the report treating Digital Reporting Requirements (DRR). We argue that the impact of real-time reporting and “e-invoicing” (definition is discussed below) can potentially be quite similar, contrary to the authors of the report. Furthermore, we show how summitto’s solution is a confidential solution for the future VAT system.

We are incredibly honoured that summitto is mentioned by the authors of the report. However, not all statements are correct and therefore in the last part we will address these issues and hope to clear up any misunderstanding!

Which type of DRR is most suitable for the European Union

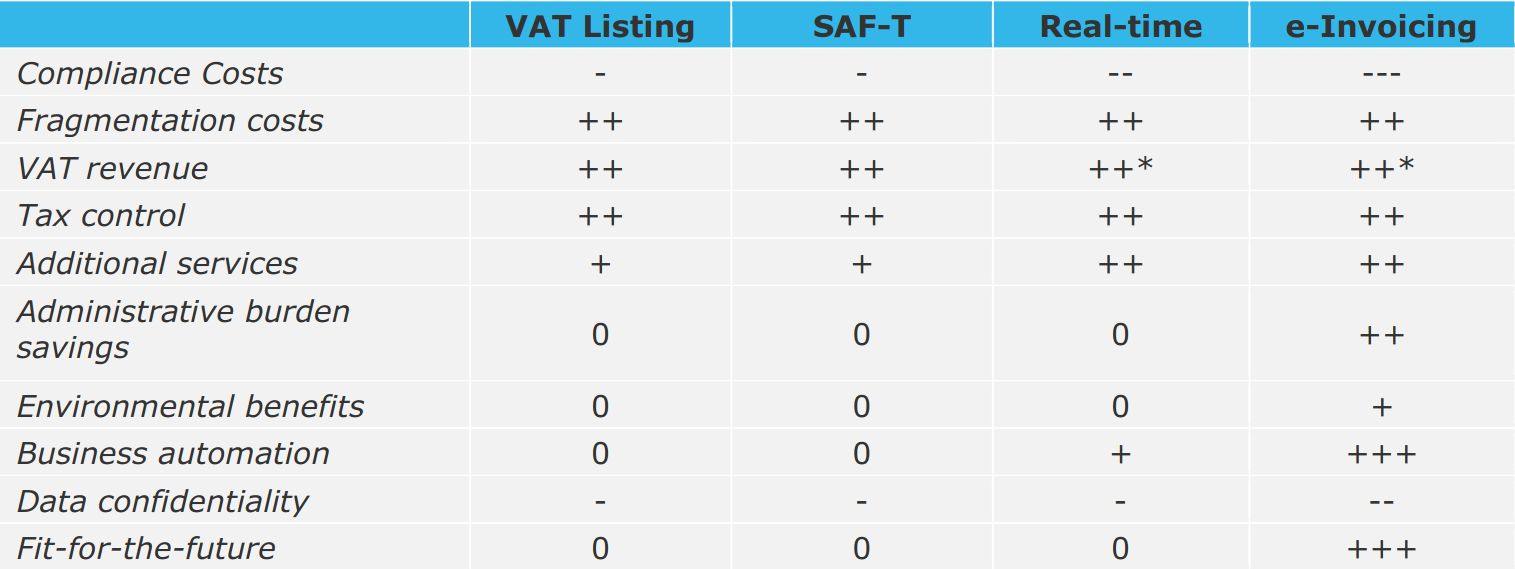

Most importantly the authors of the report found that any type of DRR will have a positive effect on tackling VAT fraud. However, some have more positive side effects, such as offering additional services and providing business automation. Out of VAT Listing, SAF-T[1], real-time reporting and e-invoicing, the latter two provide the most positive effects according to the report (see Table 1).

Table 1

Note.: +++ in the sensitivity analysis. Source: VAT in the Digital Age (2022)

E-invoicing is here defined as “any mandatory requirement to use structured e-invoices, which are then transmitted – either in full or in part, either directly or indirectly – to the tax authority.” As we have discussed previously here, technically e-invoicing is simply exchanging invoice information in a structured, computer readable form. This is not necessarily transmitted to the tax authority. So the dichotomy between real-time reporting and e-invoicing is not 100% accurate, as real-time reporting can also be coupled with e-invoicing.

Another important nuance to this table is that the only e-invoicing system discussed in the analysis is the Italian solution which is a centralised clearance solution. This solution makes taxpayers heavily dependent on the tax authority as it forwards the invoice to the buyer for them. Although not included in the table as a characteristic, it is an important reason why there are not many EU Member States willing to implement such a model. Lastly, the authors argue that blockchain-based solutions inherently come with a high energy consumption and thus large environmental costs. This is not correct as it depends on the set-up of such a system. For example, by making use of a Proof-of-Authority consensus protocol summitto’s TX++ does not consume an excessive amount of energy as we have explained here. We have included some of these considerations in Table 2, which makes clear how TX++ fits into this discussion.

Table 2

| TX++ | Real-time reporting with e-invoicing | Centralised clearance with e-invoicing | TX++ coupled with e-invoicing | |

|---|---|---|---|---|

| Compliance costs | - | - - - | - - - | - - |

| Fragmentation | ++ | ++ | ++ | ++ |

| VAT revenue | +++ | +++ | +++ | +++ |

| Tax control | ++ | ++ | ++ | ++ |

| Additional services | ++ | ++ | ++ | ++ |

| Administrative burden savings | 0 | ++ | ++ | ++ |

| Environmental benefits | 0 | + | + | + |

| Business automation | + | +++ | +++ | +++ |

| Data confidentiality | +++ | - - - | - - - | +++ |

| Fit-for-the-future | ++ | ++ | + | +++ |

Source: summitto (2022)

Note that there are only two differences to note between the systems: (1) TX++ ensures data confidentiality (2) centralised clearance introduces a bigger dependency on tax authority infrastructure, which results in lower fit for the future. In short, Table 2 shows that real-time reporting coupled with e-invoicing can achieve the same results as centralised clearance while not having to be dependent on the tax authority for forwarding invoices. One could even argue that real-time reporting is better fit for the future, as there are not many EU Member States that are in favour of a centralised clearance system. This means that in the future a Member State that makes use of this system might need to convert to a different DRR model.

Additionally, in the right column you can see TX++. When coupled with e-invoicing it can have all the positive effects of the other systems, while guaranteeing the confidentiality of the taxpayer’s data as we have explained often in the past, but which is also eloquently discussed in a recent report of the European Parliament (from p.49).

Summitto mentioned in the report: some considerations

Summitto was also discussed in the report, of which we are very proud. However, certain arguments made in the report require some nuance.

First, TX++ is only discussed in the category “blockchain”. Although blockchain and cryptography are conceptual building blocks of summitto’s solution, TX++ is first and foremost a real-time reporting system. Therefore, to really create an all-encompassing analysis, it would be helpful to compare it with other real-time reporting solutions. As we did in the previous paragraph and as the European Parliament researchers also did recently.

Second, summitto is recognized for the fact that we are transparent about TX++’s performance in terms of throughput. However, it is argued in the report that the 1255 invoices that TX++ is currently capable of handling per second, leaves “no significant margin of safety”. This is in contrast with our own findings, and that of the European Commission which found that in the entire EU 34.9 million invoices are being sent on an annual basis.[2] As there will be no pan-EU real-time reporting system for domestic transactions, this leaves a significant margin of safety. Moreover, further scalability improvements are straightforward to implement, so this is likely too technical of a topic at this point of the legislative process.

Third, the report states that the usage of blockchain “would not allow tax authorities to perform a risk analysis based on the full universe of transactions”. “The full universe of transactions” is not clearly defined, but we can confirm that even with our real-time reporting system, very advanced analytical tools can be implemented by a tax authority. We have partly discussed that here, but can provide any interested tax authority with a demonstration of TX++’s analytical capabilities.

Lastly, the authors of the report argue that “the gains in terms of data confidentiality also remain merely theoretical, considering that no occurrence of data leakages or significant safety accidents occurred with respect to existing DRRs.” Although DRRs have not been breached itself specifically, there have been many data breaches of tax authority databases. An important example was the data breach of the Bulgarian Tax Authority. Here data of almost the entire population was leaked, but also sensitive Eurofisc data.[3] More recently, the cybergang LockBit claimed that they stole 78GB from the Italian Tax Authority.[4] So although a data breach of a DRR did not happen yet, it is only a matter of time with so much valuable data being stored.

Conclusion

The authors of the report have done an excellent job in analysing the EU DRR landscape. This can serve as a basis for the legislative proposal of the EC that is being published in Q4 2022. In this blog post we showed how TX++ fits in this analysis and why it offers additional benefits to the solutions discussed in the report. TX++ (potentially combined with e-invoicing) can achieve the same results, but offers additional data protection benefits. This makes it “Fit-for-the-future”!

[1] We have discussed so called Periodic Transaction Controls (PTC) here: https://blog.summitto.com/posts/periodic_reporting_requirement_around_the_eu/

[3] https://en.wikipedia.org/wiki/2019_Bulgarian_revenue_agency_hack

[4] https://www.theregister.com/2022/07/26/lockbit-italy-ransomware-attack/