Often confused, e-invoicing and real-time reporting mechanisms are, nonetheless, distinct and entailing specific services. While e-invoicing refers to the exchange of an invoice in a structured, computer readable data format, allowing its automatic and electronic processing;[1] real-time reporting refers to the reporting of relevant invoice data to the tax authority.[2] Although both mechanisms can be implemented hand-in-hand, they can also be successful on their own.

In the following, we will explain the difference between real-time reporting and e-invoicing and how they relate to each other. Furthermore, we explain how summitto’s real-time reporting system can be integrated with open standards such as the EN16931 e-invoicing standard and the Peppol network.

The art of invoicing in a digital world

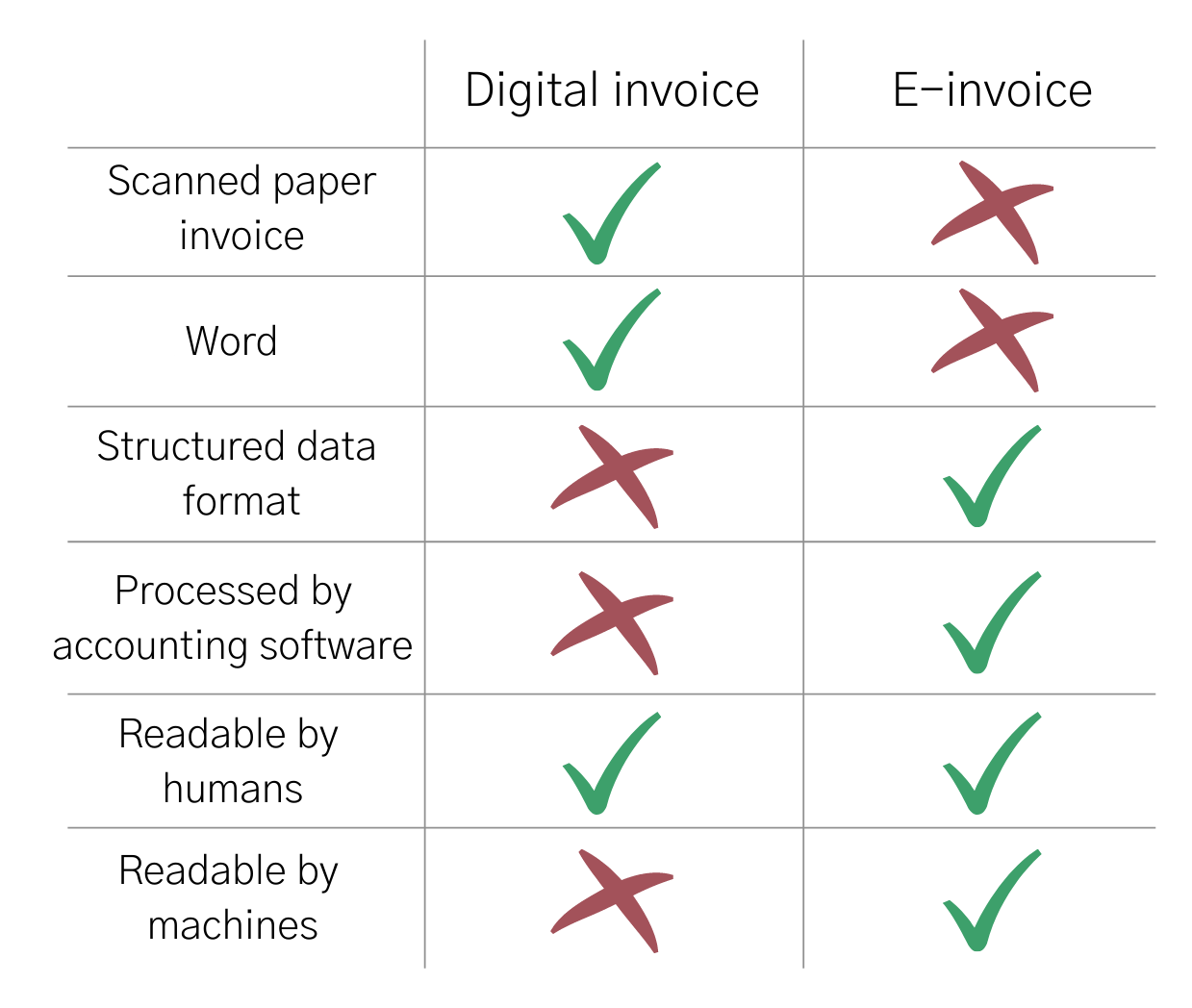

First and foremost, e-invoicing should not be mistaken with ‘digital’ invoices. A digital invoice is just a dematerialised invoice, not subjected to format requirements as e-invoices are. A digital invoice can take many forms such as PDF, Word Document, scanned paper invoice, and is easily readable by humans, but not by machine. Whereas digital invoices are mainly used for their ease of processing, archiving and are sparing paper, e-invoices serve a slightly different purpose. The format requirements allow e-invoices to be processed automatically by accounting software and systems. In the EU, e-invoicing is already mandatory for all B2G transactions.[3]

Figure 1: Digital invoice vs e-invoice

Source: summitto

The many faces of real-time reporting

Real-time reporting has several names and forms of implementation such as continuous transaction controls and transaction based reporting. Still, the idea is the same: reducing VAT fraud thanks to the transmission of VAT data in real-time or near real-time. Real-time reporting systems do not require an implementation alongside e-invoicing. The reason behind that is simple: as long as the invoices’ data are reported to the TA, the tax administration will acquire the full overview of invoice information, thus allowing the tax authority to track discrepancies and detect fraudsters. Adopting a real-time reporting system has many advantages: discrepancies are detected faster, tax procedures are optimised, and tax authorities can better monitor national economic trends.

Combining real-time reporting and e-invoicing

As stated above, real-time reporting can be easily implemented without also introducing mandatory e-invoicing. There are several reasons for governments to take this route. One reason is that only a few countries in the world have a high e-invoicing adoption rate. If mandatory e-invoicing would be introduced, this would mean that many companies need to make drastic changes to their business processes. Another reason, which only applies to EU Member States, is that the EU VAT Directive does not allow for mandatory B2B e-invoicing without the derogation of article 218 and 232. This can make national governments hesitant to implement mandatory B2B e-invoicing.

Even though there are some hurdles to combine real-time reporting and e-invoicing, the long term benefits for businesses can be enormous. For example, it will allow businesses to automate a wide variety of business processes which increases efficiency and enables employees to focus on value added tasks. Furthermore, the usage of e-invoicing reduces the cost of paper which even has a positive effect on the environment.

How can summitto’s real-time reporting system facilitate e-invoicing

Summitto develops real-time reporting software and does not provide an e-invoicing solution. However, our real-time reporting system easily integrates with e-invoicing standards such as the EN 16931 standard. This standard was developed by the European Commission “to make it possible for sellers to send invoices to many customers by using a single e-invoicing format and thus not having to adjust their sending and/or receiving to connect with individual trading parties.”[4] Moreover, data can be imported from e-invoicing networks such as Peppol. Peppol is an e-invoicing network that allows companies and governments to send and receive e-invoices. These open standards can provide tax authorities the flexibility to implement real-time reporting, while at the same time or at a later stage to encourage e-invoicing (either through an obligation or other means). This can give SMEs more time to prepare for the digitalisation of their business processes which helps them to optimally reap the benefits of e-invoicing.

[1] B. Koch (2019) The e-invoicing journey 2019-2025, Billentis, p.22 available online at: < https://www.billentis.com/The_einvoicing_journey_2019-2025.pdf >; European Commission ‘What is eInvoicing’, available online at: < https://ec.europa.eu/cefdigital/wiki/display/CEFDIGITAL/What+is+eInvoicing >

[2] Koch ‘e-invoicing journey’ (n1) p.22

[3] EU Directive 2014/55/EU.

[4] https://ec.europa.eu/cefdigital/wiki/display/CEFDIGITAL/Compliance+with+eInvoicing+standard