Complying with all regulatory requirements sometimes seems to be a burden whose only effect is to slow down businesses’ efficiency. Managing the VAT quarterly payments, filing for VAT returns, and constantly producing invoices can be stressful and time-consuming tasks. Nevertheless, modern technology can help businesses to comply with the VAT requirements while also increasing their competitiveness.

The process of the digitalisation of taxation is having a relevant impact on the time required for VAT compliance all over the world. Nevertheless, this time is still remarkably high for businesses, also in the European Union (EU). Therefore, new technologies are considered by several European countries, like Germany and France. The objective of these new technologies, like real-time reporting, is to increase compliance and reduce the VAT gap. Nevertheless, they also can improve business efficiency and competitiveness.

The Impact of VAT compliance on businesses

PwC’s 2017 study on the impact of VAT on businesses highlights the amount of time needed to comply with VAT requirements in the world. The results of the study show that the global annual average time to comply with VAT is between 25 to 200 hours. Nevertheless, the study identified important differences between countries and regions.

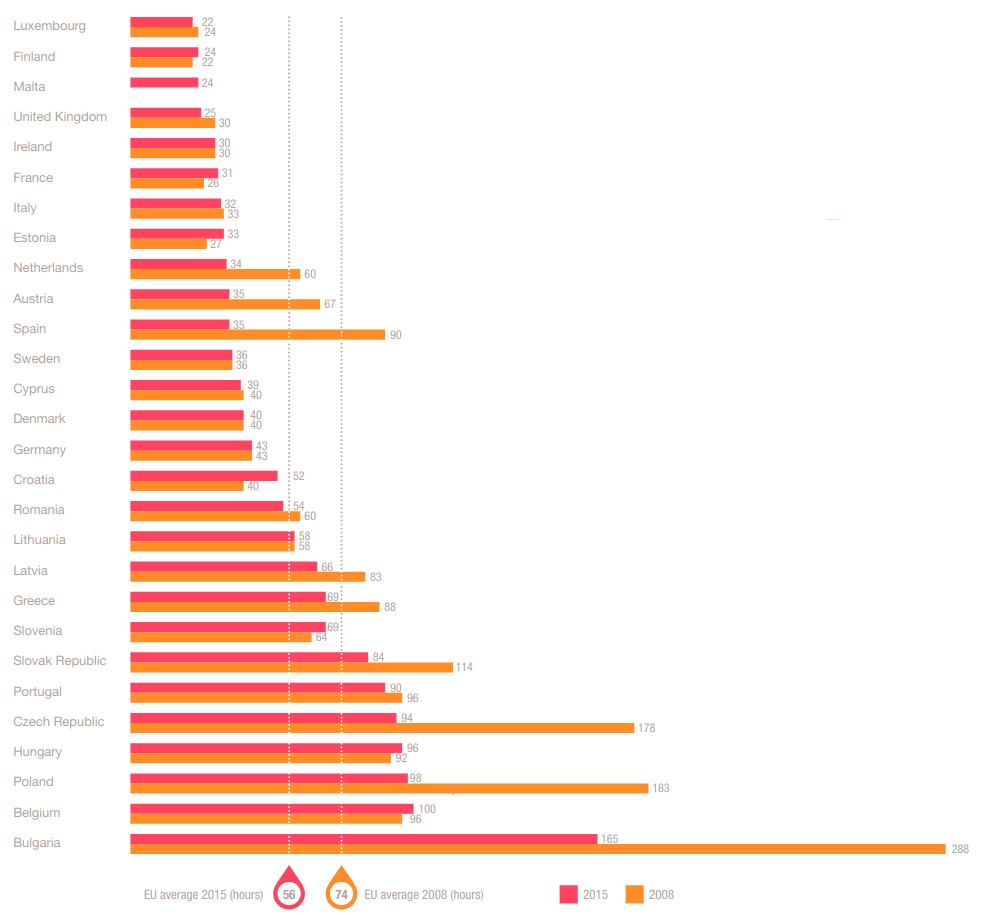

Concerning European countries, the time required for VAT compliance is 56 hours, which represents more than an average working week every year. Compliance time also depends on the European country studied, ranging from 16 hours in Luxembourg to 114 hours in Bulgaria (image 1). In general, the member states with the longer compliance times are those where additional information has to be submitted at the same time as the VAT return or where it is necessary to keep a VAT register separate from the main accounting system.

On the other hand, where the VAT compliance time is lower, this is often due to companies using advanced software that can automatically prepare VAT returns from their accounting data with little manual intervention. It takes 27% less time on average to comply with VAT obligations in countries where businesses pay and file VAT online.[1] Furthermore, stability and understandability of the tax system are also important requirements for decreasing the VAT compliance time.

Concerning the time between incurring input VAT and receiving a refund, the global average is 21.6 weeks.[2] The shortest time is in the EU and in the European Free Trade Association (EFTA)[3] region where it takes 14.8 weeks and the longest is in Central America and the Carribean with 34.7 weeks. Delays in obtaining VAT refunds can create cash flow difficulties for businesses.

Figure 1: Average compliance time in the EU 2008-2015

Source: PwC (2017)

A more efficient approach to compliance

A study from the Economist Group, a media company specialised in international business, has shown that a more efficient approach to compliance minimises the risks associated with regulatory requirements.[4]

The study is based on an online survey of 160 senior executives from services activities ranging from banking to commercial. The results show that effective regulatory compliance benefits businesses across a wide range of performance indicators. Survey respondents who consider their institution to be effective at using compliance as a source of competitive advantage derive a broad range of benefits from this proactive approach. Proactive businesses show more effective risk management, better business conduct, and also enjoy an enhanced reputation with customers and investors.

The intelligence unit highlights significant differences between businesses that only take the minimum measures required to achieve compliance and those having a more efficient approach. A non-proactive approach may save money in the short term, but it stores up problems for later. Businesses characterized by a non-proactive approach are less effective at understanding the impact of regulation on their company and are more likely to spend time and resources on regulatory activities in the future than those who take a more proactive approach.

On the contrary, respondents whose businesses run an efficient compliance process are much less likely to suffer negative consequences from failures in regulatory risk management. In fact, they are less likely to have encountered increased regulatory scrutiny from authorities and have a lower probability of suffering damage to their reputations from compliance issues. This type of situation concurs in increasing the company’s competitiveness in the long term by making it more stable and resilient.

How real-time reporting can reduce the compliance time and increase competitiveness

We have seen that the time required for VAT compliance is still significant in the EU. The more time required for compliance, the lower the competitiveness of businesses on the market. This happens on the one hand because businesses have to spend time, money and energy in the compliance process, whereas a more efficient compliance system could reduce this time. On the other hand, delays in obtaining VAT refunds can create cash flow difficulties for companies and increase financing costs.

Real-time reporting can help to reduce the time required for compliance and increase the competitiveness of businesses. By instantly reporting the relevant invoice information to the tax authorities, businesses will not be required to submit the same data twice. The system will therefore significantly reduce the time required to submit VAT information to the tax authority. This way, companies would increase productivity through a better and more efficient time management.

Real-time reporting even allows for pre-filled VAT returns. In fact, companies will only have to approve the draft of the VAT return or edit it if they find any mistake. Pre-filled VAT returns have been introduced in Chile in 2017 and the results are outstanding. Users of pre-filled VAT returns state that declaring and paying VAT is now 60% faster than before. In fact, the time required for filing VAT returns has reduced from 90 to 30 minutes.[5] In the wake of the good results of Chile, Italy has decided to implement pre-filled VAT returns starting from this year.[6]

Finally, increasing compliance through a more efficient system will help businesses to improve their risk management, to develop a better business conduct, and also to increase their reputation with customers and investors as we have seen in the paragraph above.

As we have seen, real-time reporting is a valid improvement for businesses’ everyday operations and not just for tax authorities. It can increase companies’ efficiency, improve cash flow and boost their competitiveness. The implementation of real-time reporting can therefore be beneficial both for the public and the private sector.

In case you want to learn more about how summitto’s real-time reporting system exactly works and how it benefits both the public and private sector click here. For questions, shoot us a message at info@summitto.com

[1] Jo Bello: VAT compliance, the impact on businesses and how technology can help, PWC. https://www.pwc-tls.it/it/assets/docs/pwc-vat-compliance-paying-taxes-2017.pdf

[2] Idem.

[3] EFTA member states: Iceland, Norway, Switzerland, Liechtenstein.

[4] Compliance and competitiveness: the economist intelligence unit. http://eiuperspectives-stage.economist.com/sites/default/files/EIU-Sybase_FS%20regulation%20.pdf

[5] ICT as a strategic tool to leapfrog the efficiency of tax administrations. https://www.ciat.org/Biblioteca/Estudios/2020-ICT_STL_CIAT_FMGB.pdf

[6] Parliamentary audition of the director of the Italian Tax authority. https://www.camera.it/leg18/1132?shadow_primapagina=10785