Closing the VAT gap, data protection and digitalisation. These are just a couple of the advantages of summitto’s real-time reporting software we have outlined in previous blog posts. In this blog post we will add yet another benefit to the list: monitoring economic activity. This can be used to develop forecasts and e.g. determine which economic sector is hit hardest by the COVID-19 crisis. This additional benefit is actually one of the reasons why real-time reporting can even be interesting for a country that does not have an excessive VAT gap. In the following, we will first have a look at how existing real-time reporting solutions make use of this additional tool. This was already eloquently analysed by Sovos recently. What we want to add with this blog post is to show that the same results can be achieved without storing any actual data.

Monitoring economic activity through real-time reporting

Recently, Italy has shown how real-time reporting can help to monitor economic activity. Italy implemented its real-time reporting system, the Sistema di Interscambio which is coupled with a mandatory e-invoicing regime, in 2019. Because it allows the tax authority access to taxpayer data in real-time, the Italian government is perfectly able to assess which economic sector and which businesses suffered losses from the COVID-19 crisis and the corresponding lockdown measures. In this way, the tax authority knows exactly which company is eligible for relief measures, such as tax breaks or subsidies.

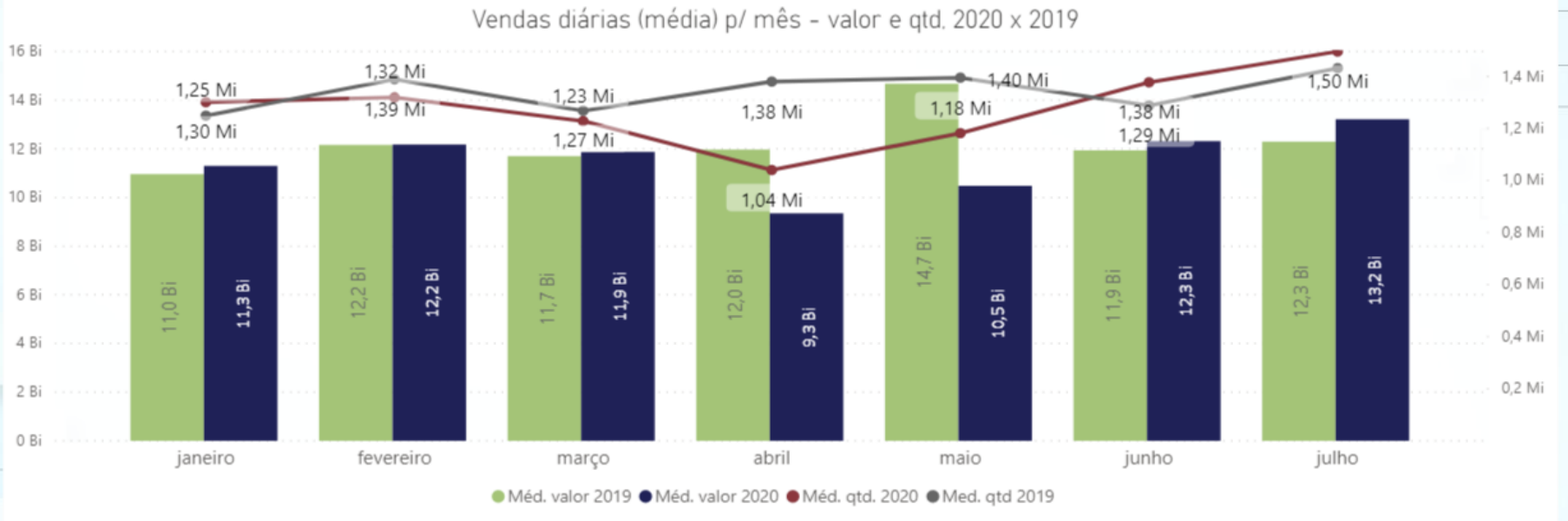

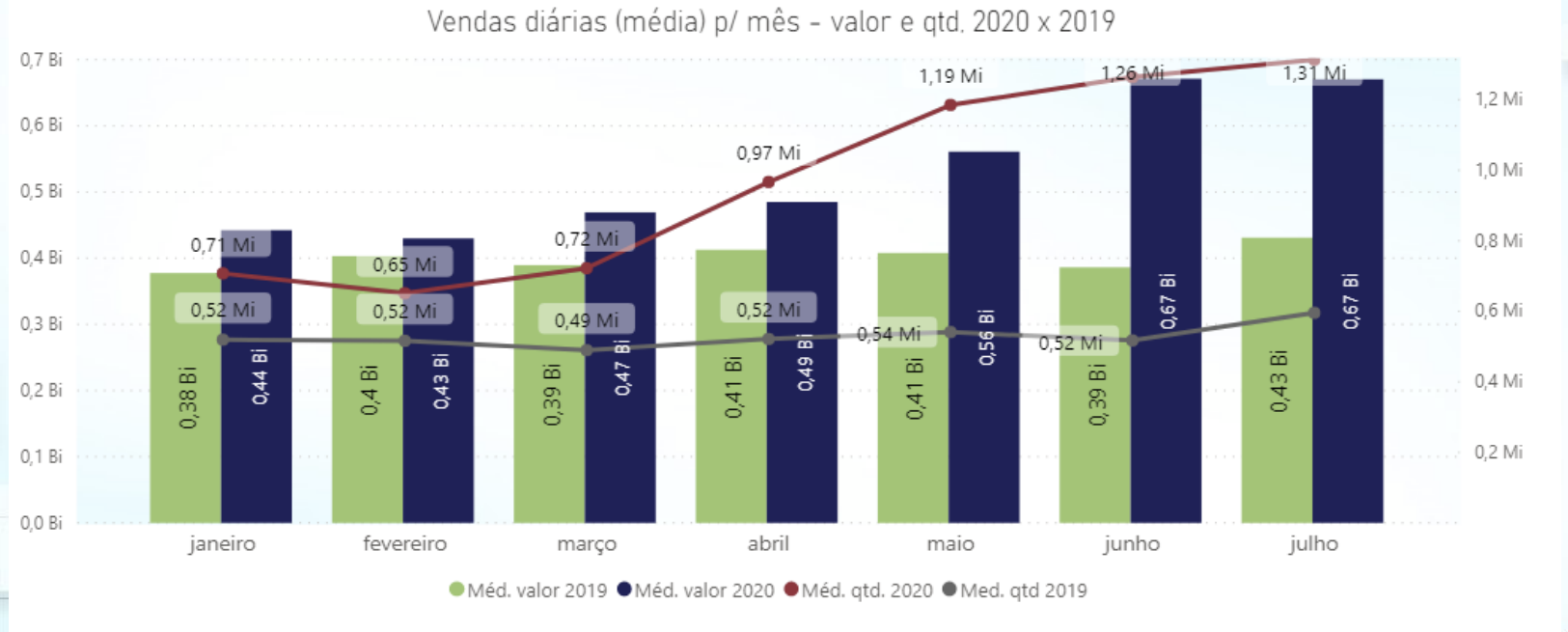

Brazil is yet another example of a country that makes use of this type of information to optimise its COVID-19 relief programme. Brazil was actually one of the first countries in the world to make use of real-time reporting, and can therefore be called a true pioneer in the world of VAT. As a result of real-time reporting, it saw its tax revenue grow by $58 billion.[1] The “fiscal electronic notes” (called NF-e) are also used to observe the effects of COVID-19 on economic activity.[2] We took two graphs from the Brazilian Tax Authority’s Bulletin published in August 2020, which show how useful this monitoring can be. Whereas in Figure 1 you can see that the sales of the “Industry” sector massively fell during the first months of the COVID-19 crisis, Figure 2 shows that the “Ecommerce” sector flourished during the same period. Having access to this type of data has many advantages and allows governments to quickly adapt their policies if necessary.

Figure 1: Sales in the “Industry” sector

Source: Boletim Da Receita Federal, Impactos Da COVID-19 - August 2020

Figure 1: Sales in the “Ecommerce” sector

Source: Boletim Da Receita Federal, Impactos Da COVID-19 - August 2020

Monitoring economic activity in a confidential way

A downside of this way of economic monitoring through existing real-time reporting solutions is that often authorised public officials have access to the invoice data in plain text. As we have explained here, this could have disastrous consequences, as it leaves the door open for data breaches. When invoices are leaked, this means that pricing information is also leaked and when pricing information ends up in the wrong hands it could ultimately hurt the entire economy.

A confidential system can create the same level of detail displayed in the graphs above with no need for any additional information by the taxpayer and at the same time all data is secure!

By applying modern technologies, such as cryptography, to real-time reporting this problem can be overcome, while the same results in terms of an increased government revenue can be achieved. When invoices are reported through such a confidential real-time reporting system, all invoice data will be encrypted and no one but the owner(s) of the data can provide access to actual invoice data. The tax authority will only receive aggregated information about the VAT due to taxpayers. In this way the VAT gap can be closed in a 100% confidential manner. This aggregated data can also be used to monitor the economic activities of companies without having access to all the detailed information. It is even possible to aggregate by company type (e.g. small, medium or large) or any other common and well-defined type. However, we advise tax authorities to be cautious, because the more of these aggregations are executed, the more data can be leaked. This gives governments information about the economic activity per sector and even per company which could help them in assessing which of these companies need government support, while guaranteeing the confidentiality of the taxpayer.

All in all, by combining real-time reporting and modern technologies, it is possible to close the VAT gap, monitor economic activities and optimally protect the valuable invoice data of taxpayers.

In case you want to learn more about how summitto’s real-time reporting system exactly works and how it benefits both the public and private sector click here. For questions, shoot us a message at info@summitto.com

[1] https://www.billentis.com/The_einvoicing_journey_2019-2025.pdf