Introduction

Many governments all over the world are currently deciding what type of real-time reporting system they want to implement. With this blog post we hope to assist these governments by showing various design options of real-time reporting. In the following we will analyse four different real-time reporting solutions after which we will compare those with summitto’s own real-time reporting solution: TX++. We will explain that TX++ can achieve the same results as any other real-time reporting system, while at the same time:

(1) TX++ accepts all invoicing standards;

(2) does not require clearance;

(3) optimally protects taxpayer’s data;

(4) provides additional value to companies.

Real-time reporting in Hungary

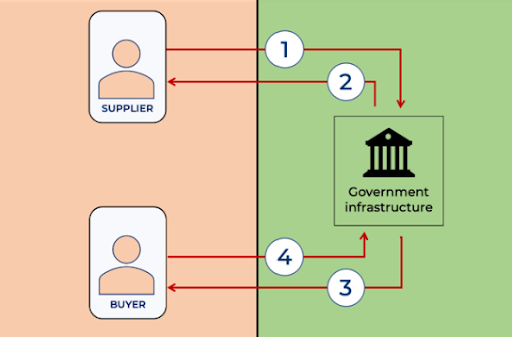

As we explained previously, real-time reporting does not necessarily have to involve mandatory e-invoicing. Hungary applied this thesis when implementing their Real-Time Invoice Reporting (RTIR) system in 2018. The latest update (3.0) of the system was introduced in January 2021, which requires all invoices to be reported to the Hungarian tax authority in real-time. In this system, suppliers can send their invoice to the buyer (1) in their prefered format. However, the data sent to the tax authority (2) needs to be sent in a specified XML format. In version 3.0, the Hungarian tax authority also allows buyers to download the reported XML file from the tax authority system.[1]

Figure 1: real-time reporting in Hungary

Source: Peppol (2021)

Centralised clearance in Italy

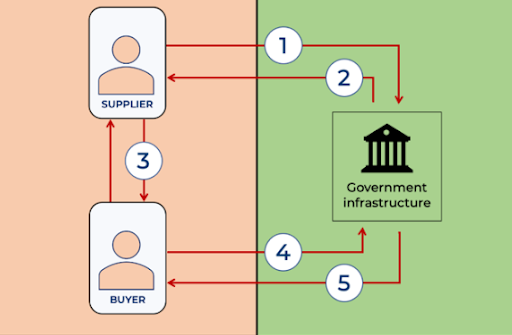

Centralised clearance is another form of real-time reporting (Figure 2). As opposed to the Hungarian system, Italy decided to couple real-time reporting with mandatory B2B e-invoicing. This model, implemented in January 2019, is called the Sistema di Interscambio (SdI) and requires every taxpayer to send their invoices (in a standardised e-invoicing format called FatturaPA) to the tax authority (1). The tax authority then “clears” the invoice (2) and forwards it to the buyer (3). When the buyer receives the invoice, it will send a confirmation to the tax authority (4).

Figure 2: real-time reporting in Italy - centralised clearance

Source: Peppol (2021)

Clearance in Brazil

The most important similarity between the real-time reporting in Italy and Brazil is the central role of the tax authority. The big difference however is that the supplier is still in charge of sending the invoice to the buyer. The process is as follows: the supplier sends its e-invoice[2] to the tax authority (1), the tax authority clears it (2) and only afterwards the supplier is allowed to send the invoice to the buyer (3). The buyer has to check with the tax authority if the correct invoice is reported (4), after which (in case the invoice is indeed valid) the buyer receives a confirmation from the tax authority (5). There are many different variants of this model. For example, where the clearance platform is a third party service provider (read our blog about the Mexican real-time reporting system).[3]

Figure 3: real-time reporting in Brazil - clearance

Source: Peppol (2021)

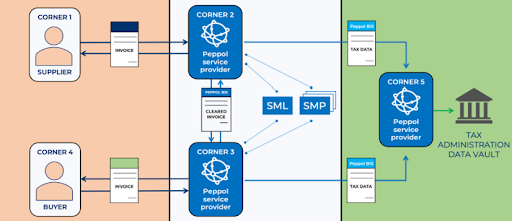

Decentralised clearance: Peppol Continuous Transaction Controls model

In order to provide a solution that can help a wide variety of tax authorities, the OpenPeppol organisation developed their Peppol Continuous Transaction Controls (CTC) model. OpenPeppol is the non-profit organisation behind the Peppol network, which enables all types of entities to exchange e-invoices between each other. In this model, an invoice is sent from a supplier (corner 1) to a Peppol service provider (corner 2). This Peppol service provider clears and forwards the invoice to the Peppol service provider (corner 3) used by the buyer (corner 4). Via corner 3, the buyer will receive its invoice. At the same time, both corner 2 and corner 3 share relevant tax data with the tax authority (corner 5).

Figure 4: real-time reporting with Peppol - Peppol CTC

Source: Peppol (2021)

Pros and cons of existing solutions

We have listed the pros and cons of the different real-time reporting solutions in the table below. Important to note is that all solutions have the potential, when implemented correctly, to tackle VAT fraud. However, of the discussed solutions only Peppol and the Hungarian model don’t make use of clearance.[4] This means that in these systems companies will not depend on the tax authority for sending their invoice. Furthermore, all systems are strict on the invoice standard that is used. Only Hungary allows companies to use their preferred invoicing standard for the exchange between suppliers and buyers. However, a strict standard is asked for reporting to the tax authority specifically. Lastly, none apply strict data protection tools to optimally protect taxpayers data.[5]

You can also see that TX++ checks all the boxes in the table below, let’s explain why.

| Potential to fight fraud | No clearance | Standard agnostic | Optimal data protection | Additional benefits for businesses | |

|---|---|---|---|---|---|

| Italian model | ✔️ | ❌ | ❌ | ❌ | ❌ |

| Brazilian model | ✔️ | ❌ | ❌ | ❌ | ❌ |

| Peppol CTC | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| Hungarian model | ✔️ | ✔️ | Partly | ❌ | ❌ |

| TX++ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

TX++: real-time reporting in a business-friendly and secure way

The common denominator between the real-time reporting systems discussed above and TX++ is that there is a certain obligation to report invoice information to the tax authority. The main difference is how this invoice is reported.

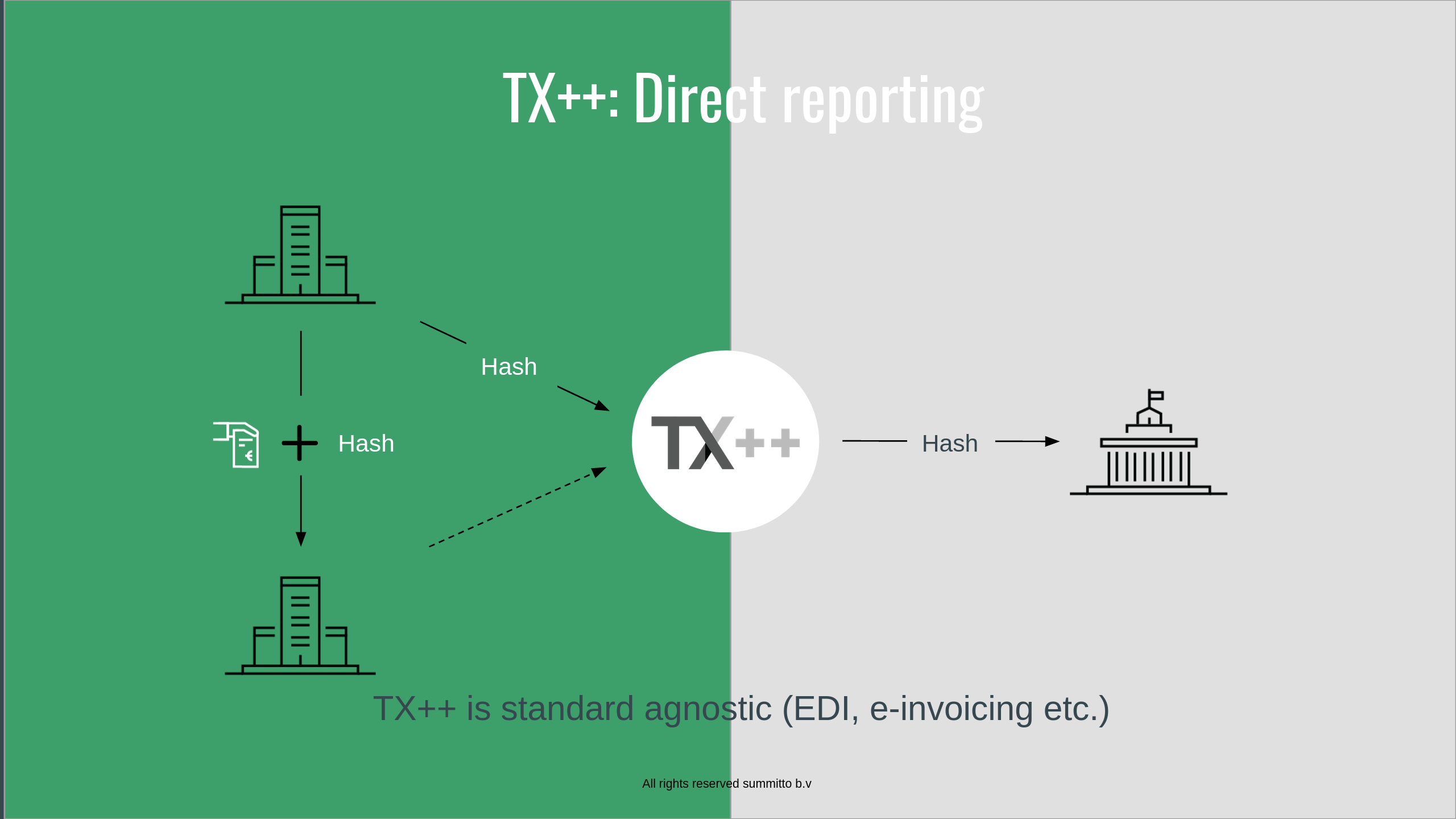

Figure 5 shows that the supplier only sends a hash to TX++ (which is under control of the tax authority). This hash is an encrypted fingerprint of the invoice and cannot be traced back to the actual invoice information (we have explained this concept in depth here). At the same time, a reference to the registration is added to the invoice which is sent to the buyer. This enables both the buyer and supplier to prove that the invoice was actually reported to the tax authority. In this way verified financial information is created which can be used by companies to e.g. automate audits (read more about this concept here). Subsequently, modern cryptography helps the companies prove how much they registered in aggregate and enables the tax authority to match the VAT return of the supplier with the VAT return of the buyer. In other words, the same results as all systems above can be achieved without storing any invoice information.

Figure 5: real-time reporting in a business friendly and secure way - TX++

Source: summitto (2021)

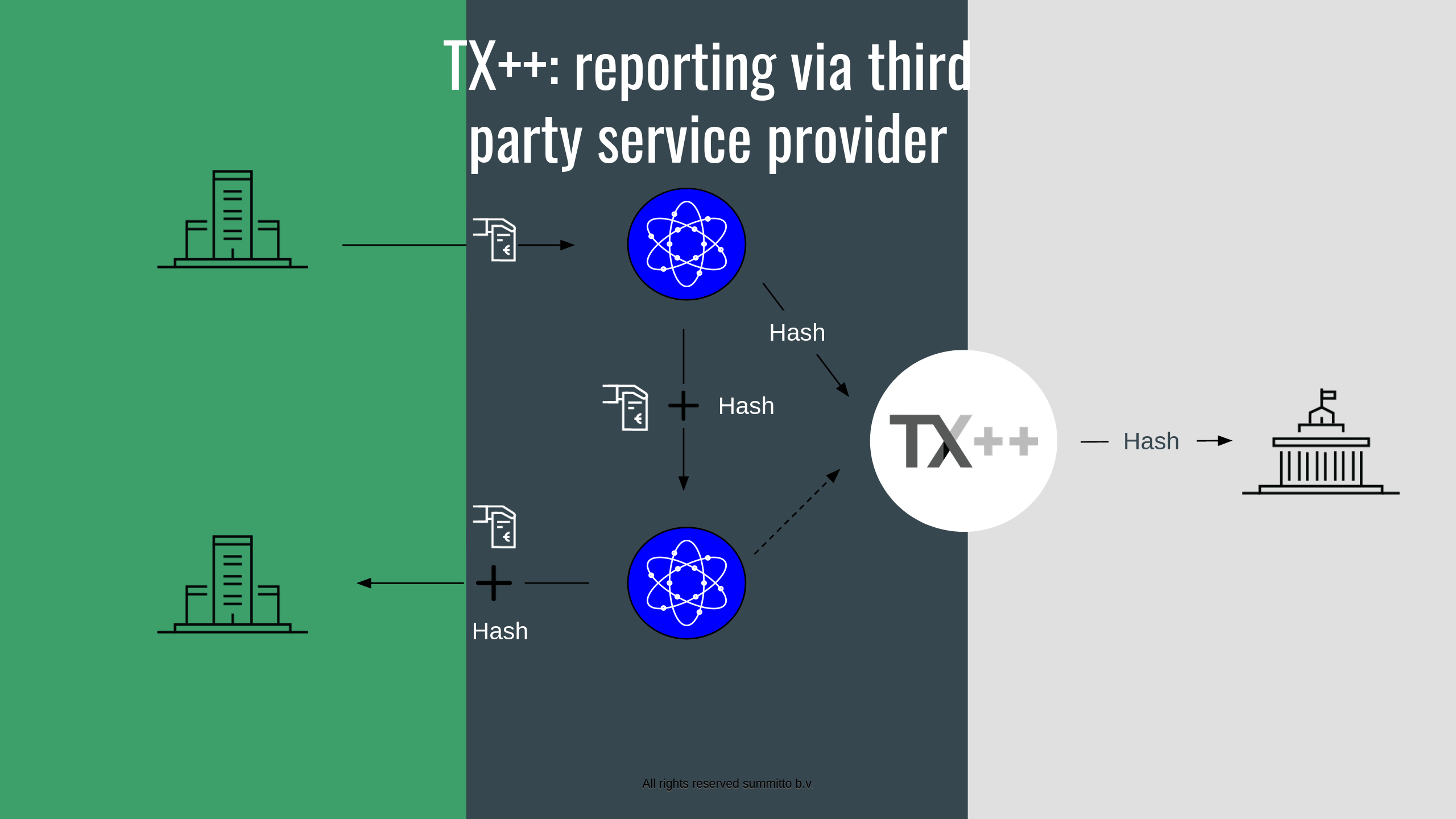

Additionally, TX++ accepts all invoicing standards. In this way companies which already have an EDI infrastructure in place, only need to make minimal adjustments to comply with real-time reporting. At the same time TX++ can also be coupled with a third party service provider (as Peppol). It works almost the same way as the Peppol CTC, making use of the 4 corners. The main difference is the fifth corner, which becomes TX++. In this way, the same set-up as Peppol CTC, but then with optimal data protection can be achieved.

Figure 6: TX++ integrated with third party service providers

Source: summitto (2021)

Conclusion

Amidst the ongoing debates about real-time reporting all over the world, we hope this article provides some clarity about the different real-time reporting options that are out there. Furthermore, we explained how summitto’s real-time reporting solution (TX++) differs from other solutions. The main goals are the same (tackling fraud by sending invoice information to the tax authority), but how the goals are achieved differs. TX++ is the only real-time reporting system which accepts all invoicing standards, does not require any form of clearance and is not storing any actual invoice data. Thus, creating a truly business-friendly and secure real-time reporting system.

For questions, shoot us a message at info@summitto.com

[2] There are many different types of e-invoices and documents that need to be reported/archived. Read more about the process here: https://www.totvs.com/blog/adequacao-a-legislacao/sped-fiscal/

[3] A discussion of all these different variants is outside the scope of this article. A recent report of OpenPeppol offers an excellent overview: https://peppol.eu/wp-content/uploads/2021/09/Peppol-CTC-Reference-Document-v1.0.pdf

[4] The Peppol CTC offers a decentralised ‘clearance’, similar to the Mexican model. However, this does not affect the invoice workflow of companies.

[5] We have previously written a blog post explaining why only reporting metadata (Peppol CTC) is not the answer to the problem at hand: Peppol uses metadata: https://blog.summitto.com/posts/risk_without_benefits_data_minimisation_is_not_the_solution/