Recently the winning parties of the German elections came to a coalition agreement. The SPD (social democrats), the Bündnis 90/Die Grünen (greens) and the FDP (liberals) prepared a 177-page document to present their plans for a “free, just and sustainable” Germany. And lucky for our readers they also talk about VAT! More specifically, they intend to implement real-time reporting: “We will introduce a uniform nationwide electronic reporting system as soon as possible, which will be used for the creation, checking and forwarding of invoices.”[1] This is very exciting news! In the following we will provide some background information about the German VAT gap, explain to what extent Germany is digitised and show what Germany can learn from already existing solutions.

Why does Germany want to implement a real-time reporting system?

The most recent European Commission (EC) calculations of the VAT gap shows that in absolute terms Germany has one of the highest VAT gaps within the European Union (EU), amounting to €23.4 billion in 2018. In terms of percentage to the total VAT revenue Germany performs better than average with 8.8%.[2] Still, this is an enormous amount of money and measures are necessary to close this gap. That’s why the new so-called “Traffic light coalition” now proposes to implement a real-time reporting system. Besides reducing the “susceptibility to fraud” of the German VAT system, the introduction of real-time reporting also serves to reduce the administrative burden by digitalising VAT. Before diving deeper into what the coalition should take into account when implementing such a solution, let’s first find out how the invoicing landscape of Germany looks like.

Digitisation and e-invoicing in Germany

Digitisation is one of the goals of the implementation of real-time reporting. In order to effectively analyse what Germany can learn from previously implemented real-time reporting systems, it’s important to have a clear overview of how digitised the German invoicing landscape is. First of all, we can have a look at how many companies make use of bookkeeping software.

According to Eurostat at this moment 13% of all companies make use of cloud-based “finance or accounting software”. This figure grew rapidly the last couple of years, being 4% in 2014. However, compared to the EU average (16%) and especially to a country such as Denmark (40%) there is still a lot of room for improval. The implementation of real-time reporting can offer this improval as is shown by Italy, going from 8% in 2018 (before the implementation of the SdI) to 28% in 2020 (one year after the implementation of the SdI).[3]

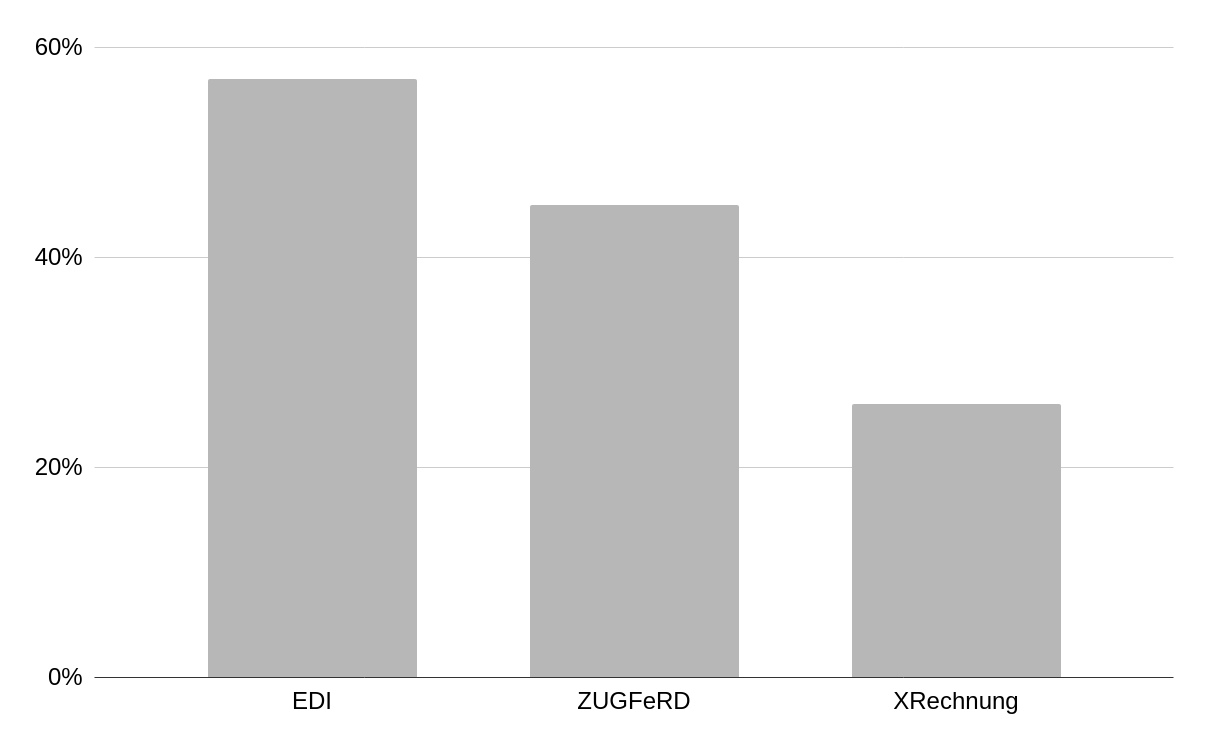

Also interesting for this discussion is what the e-invoicing landscape of Germany looks like. According to Fabian Bocek from the Arbeitsgemeinschaft für wirtschaftliche Verwaltung, 25% of invoices are sent in a digital fashion. This includes, however, non-computer readable documents such as PDF (as we have explained here). This means that an astonishing 75% of the invoices is still paper based.[4] Of the companies that do make use of computer readable invoices, 57% use EDI, 45% ZUGFeRD and 26% XRechnung a survey with 502 companies found out.[5] This shows that some companies even use multiple standards.

Figure 1: Usage different e-invoicing standards (total is higher than 100%)

Source: Bitkom (2021))

This brief analysis shows that the digitalisation of invoices should really be improved to which real-time reporting can be a great solution. On the other hand, it also shows that there is a fragmentation in terms of invoicing standards used.

Three aspects to consider for the German government when implementing real-time reporting

As we previously explained, there are different ways of implementing real-time reporting. The way real-time reporting is implemented impacts companies. Therefore, the country’s specific characteristics should always be taken into account. Although not all-encompassing, for Germany these are a high percentage of companies using EDI and a strict data protection regulation.[6] In the following, we discuss some recommendations.

Offer flexibility in terms of invoicing standards

The diverse e-invoicing landscape shows that multiple standards should be accepted when a real-time reporting system is implemented. Otherwise, companies that already have some sort of EDI/e-invoicing solution in place need to invest heavily in order to adapt to the strict e-invoicing standard made mandatory by the government. The real-time reporting proposal of France shows that a strict e-invoicing standard is not necessary, while summitto’s real-time reporting system also allows for the acceptance of any e-invoicing standard.

Protect taxpayer’s data

Especially for the country that invented the word Datensparzamkeit and has a very strict data protection act[7], it’s of utmost importance to (1) only collect data that is absolutely necessary to fight fraud and (2) to optimally protect this data. It would be even better, if no data was collected at all. This is exactly what modern cryptography can offer. By making automated calculations on fully encrypted invoice information, summitto’s real-time reporting software can tackle VAT fraud without storing any valuable taxpayer data.

Provide additional benefits for businesses

Real-time reporting is a great tool to further digitise invoicing which will reduce the administrative burden. However, it also comes with a different form of compliance. Therefore it’s essential to make such a solution as attractive as possible for companies. In this light, it’s remarkable that Germany plans to use real-time reporting “for the creation, checking and forwarding of invoices.” This seems to point towards a centralised clearance system. That would not be a feasible solution for Germany as it means that all data is centrally stored (see previous paragraph) and it will make companies dependent on the government in terms of being able to send invoices. In other words, if the clearance system fails, no invoices can be sent anymore.

Additionally, it is often seen that with real-time reporting solutions VAT data ends up in a “black box” of the government. This means that companies cannot use the reported information for anything else than VAT. Summitto’s real-time reporting solution enables companies to reuse the reported information for e.g. the automation of audits, or in order to provide mathematical proof to investors of their revenue. The main point is that when real-time reporting is implemented in this way it offers additional benefits to businesses besides that VAT returns can be pre-filled, VAT payout can be accelerated and processes can be digitised. We explain this aspect a bit further in this blog post.

Conclusion

It’s great that Germany will be the next country that is implementing real-time reporting. Yet, there are still many open questions regarding how this implementation would actually look like. Our main advice based on, amongst others, the state of digitisation of Germany is:

- Offer flexibility in terms of standards;

- Protect taxpayer’s data;

- And provide additional benefits for businesses.

For questions, shoot us a message at info@summitto.com

[1] https://www.spd.de/fileadmin/Dokumente/Koalitionsvertrag/Koalitionsvertrag_2021-2025.pdf

[2] https://ec.europa.eu/taxation_customs/business/vat/vat-gap_en

[3] https://ec.europa.eu/eurostat/databrowser/view/isoc_cicce_use/default/table?lang=en

[4] https://www.impulse.de/it-technik/technik-trends/xrechnung/7493742.html

[5] https://www.bitkom.org/Presse/Presseinformation/Elektronische-Rechnungen-in-der-Breite

[6] https://www.dotmagazine.online/issues/security/germany-land-of-data-protection-and-security-but-why