Introduction

After analysing real-time reporting systems in several countries around the world in our previous blog-posts, we wish to focus today on one of the first real-time reporting systems of Asia: the South Korean one. South Korea introduced a real-time reporting system as far back as 2011 and is one of the most advanced countries in this area in Asia.

In order to better understand how the system works, we will first present an overview of the developments which led to the current system in the country. We will analyse its functioning and requirements and in the last part we will outline future developments in the country.

A brief overview of the South Korean reporting system

VAT was introduced in Korea in 1977 at a standard rate of 10.0%, which is relatively low in comparison to the current OECD average. The standard rate has remained unchanged till today, with a reduced rate of 0% on certain machinery and materials for agriculture, fishery, livestock, and forestry.

South Korea has a long history of invoice reporting, which was already part of the South Korean business culture even before the introduction of e-invoicing in 2011. Before this date, taxpayers in the country were already obliged to share their paper invoices, together with the VAT return, with the National Tax Authority in order to prevent fraud and reduce the South Korean VAT gap.[1]

In 2011, the government of South Korea decided to introduce mandatory B2B e-invoicing. It became first mandatory for businesses generating sales above 1 billion KRW (around $900,000 at that time). Currently, the e-invoicing mandate applies to all businesses with a turnover equal or above $250,000 and this will be further reduced to $160,000 in July 2022 in order to apply to the great majority of South Korean companies.

Functioning

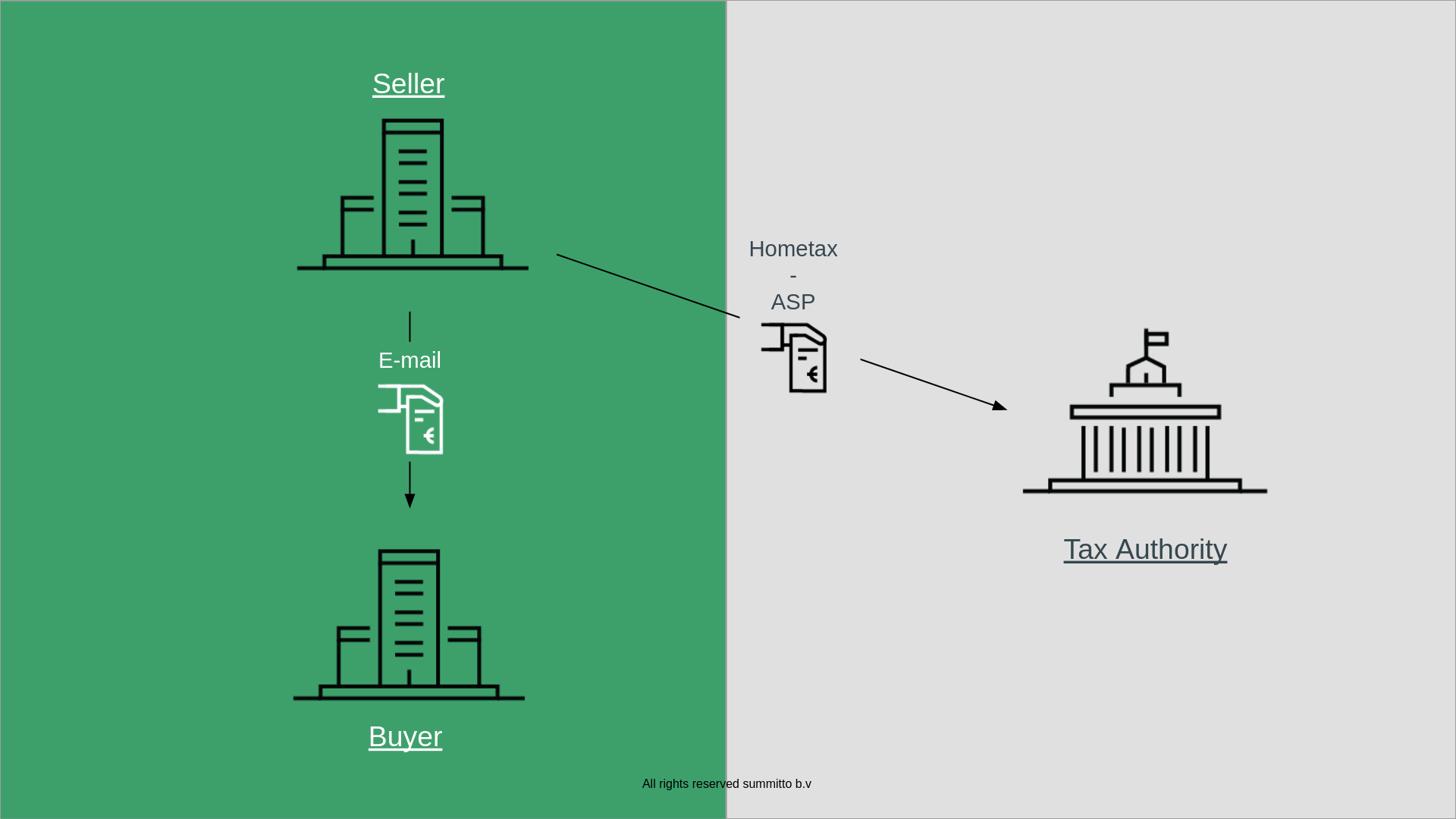

In order to be compliant with the e-invoice mandate in South Korea, businesses first need to apply for an electronic certification from the tax authority and register on the hometax portal or choose a third party service provider. To issue an e-invoice, suppliers need their customers’ tax registration certificate for matching the invoice to a customer, who will receive the invoice through an email-service.

Figure 1: Real-time reporting in South Korea

Source: summitto (2022)

South Korea established an XML-based standard. E-invoices can be transmitted to the national tax authority, within one day after their issuance, in three different ways[2]:

- Using the Hometax portal run by the tax authority. This is mainly used by businesses with a small number of transactions.

- Integration with the internal ERP system of the company or through third party service providers (ASP). This service is mainly used by larger companies.

- Messaging system: this solution, which is not common to other e-invoicing systems, allows companies to communicate their invoice information through a dedicated Automated Voice Response System (AVRS)[3]. This service is mostly used in case of limited internet connection.

Results

According to the European Parliament Research Service, the introduction of invoice reporting in South Korea reduced tax compliance costs for businesses and at the same time increased tax compliance.[4] Furthermore, positive results can be seen in state revenues growth connected to VAT since 2011.

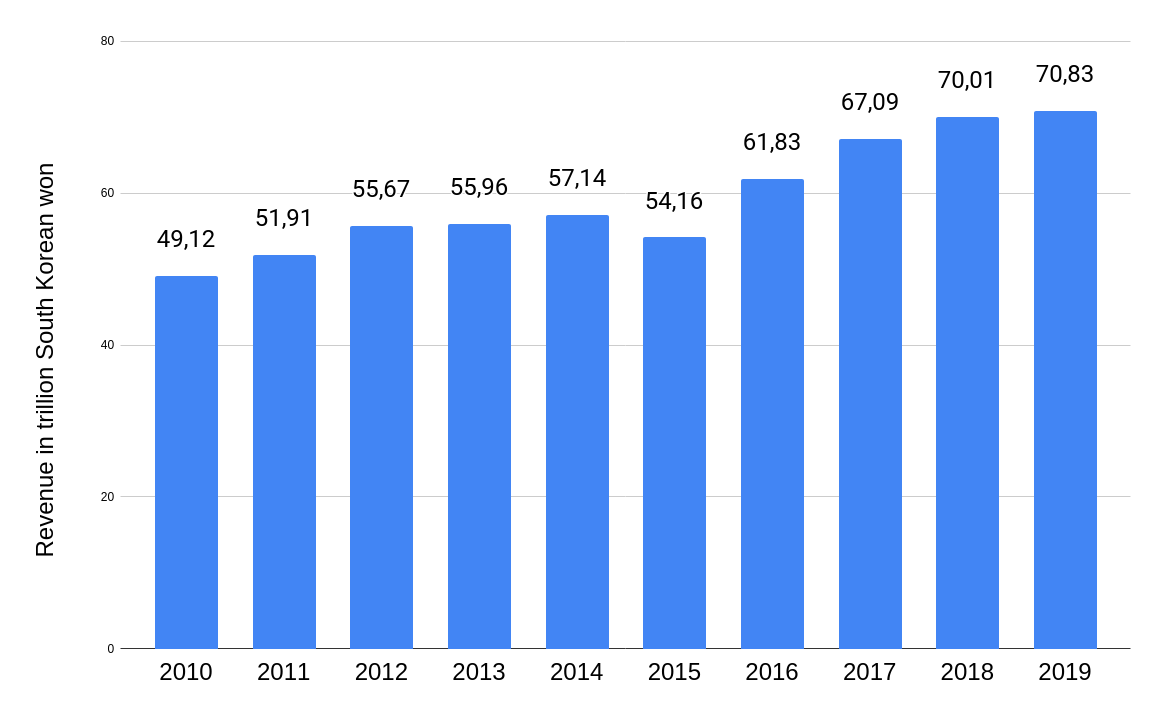

Figure 1: VAT revenue in South Korea

Source: Statista (2022)

As shown in the chart above, since the introduction of the e-invoicing mandate in South Korea in 2011 VAT state revenues surged from KRW 51.91 trillion to KRW 70.83.[5] It is an increase of around KRW 19 trillion, or 36% more compared to VAT revenues from 2011.

Also on the business side, the introduction of real-time reporting in South Korea had a positive impact on the tax compliance costs of businesses. The Korean institute of Public Finance estimated a reduction of KRW 978 billion ($ 890 million) in compliance costs for businesses.[6]

Conclusion

South Korea was one of the first countries in the world to introduce real-time reporting already more than ten years ago. Results show that the technology had a major impact on state revenues and helped to reduce the burden on businesses. Similar important results have been witnessed also in Latin American and European countries implementing real-time reporting. It is important to consider countries that have already taken the decision to introduce real-time reporting as an example in Europe in order to develop the most suitable system for European citizens.

In case you want to know more about our real-time reporting solution have a look at our website at www.summitto.com or do not hesitate to contact us at info@summitto.com

[1] Before 1994/1995 companies were required to sent paper-based invoices to the tax authority together with their VAT return. Afterwards, an aggreate summary became sufficient. The South Korean tax authority then computarised this information to detect discrepancies between buyers and suppliers: https://documents1.worldbank.org/curated/en/712881467994710005/pdf/WPS7592.pdf

[2] https://www.avalara.com/vatlive/en/country-guides/asia/south-korea/south-korea-e-invoices.html

[3] The AVRS system is a telephone line to communicate invoices to the South Korean tax authority. After the communication, documentation must be presented as a proof of the invoices issued.

[4] https://www.europarl.europa.eu/RegData/etudes/STUD/2021/694215/EPRS_STU(2021)694215_EN.pdf

[5] https://www.statista.com/statistics/1231751/south-korea-vat-revenue/