VAT Talks with Alfredo Collosa

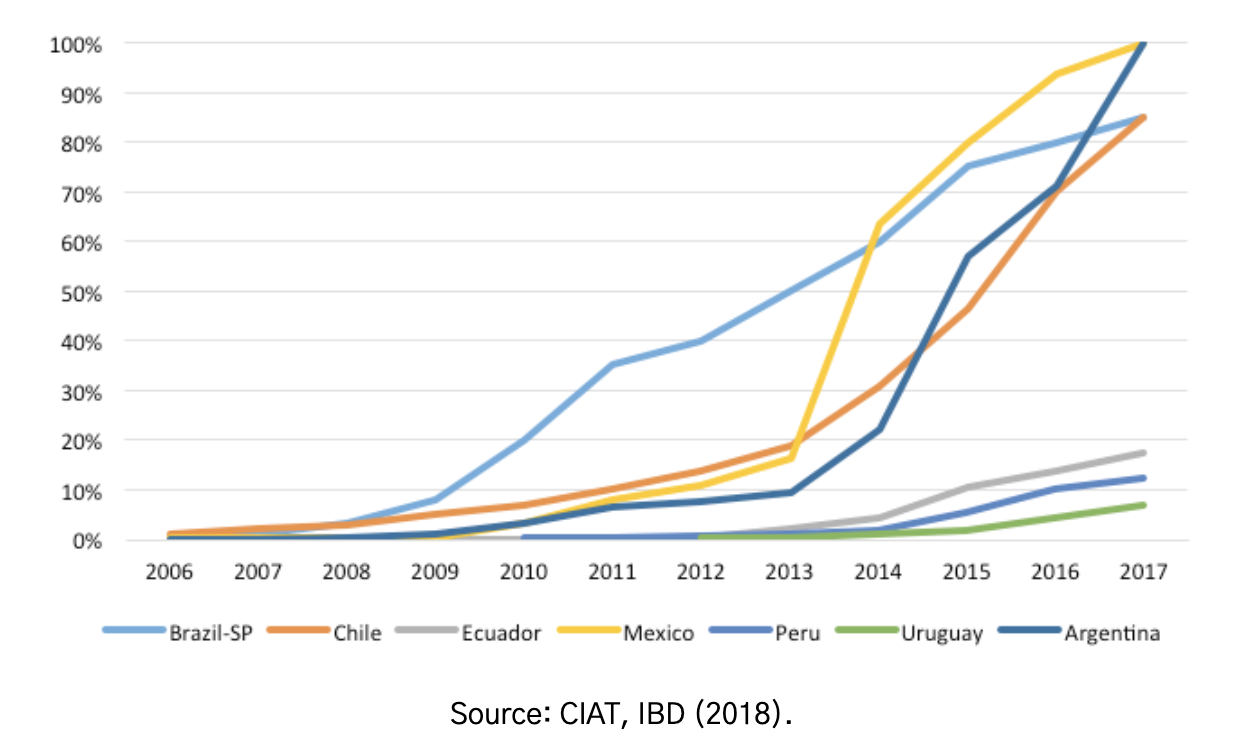

In this episode of VAT Talks we speak with Alfredo Collosa, who has been working in taxation (with i.a. AFIP, CIAT and IMF) for more than 30 years. We are pleased to discuss VAT with a tax expert from Latin-America, as that region pioneered in the usage of e-invoicing and invoice reporting systems (see Figure 1). In this article, Alfredo explains why this development could occur specifically in Latin-America, we discuss the differences between Latin-America and the EU and he tells us why taxation is not boring at all.

Figure 1: e-invoicing in Latin-America

For how long have you been working in taxation and how did you end up in this field of work?

“It has been 30 years now. I studied accounting and started working as a student with the AFIP (Argentina Tax Authority). From there I started giving classes in taxation, writing articles and participating in monograph competitions. Afterwards I decided to study Business Administration. I tried to find the link between this field of work and taxation; in the end I obtained my Masters degree in Tax Administration.”

What do you like so much about taxation and VAT in specific?

“I see taxes as an essential tool to improve the quality of life of citizens. It provides the resources that the state needs to finance its public expenses. That’s what I like most about taxes. Of course, they need to be well administered and collected, then taxes are really helpful in reducing inequality and poverty.”

“As for VAT, VAT has many advantages. The foremost advantage is that it is a tax that is relatively easy to manage and to collect compared to other taxes, such as personal income tax.The disadvantage is that VAT is a regressive form of taxation. This means that when someone with a lower income, buys a liter of milk in the supermarket, he/she pays just as much VAT as someone with a higher income.

As you just mentioned that taxes can help in overcoming this inequality, how important is VAT in this regard?

“What I want to emphasise is that in Latin-America the amount of taxes collected equals 23% percent of the GDP, whereas in OECD countries this figure is 34%. This is a very big difference in taxes collected. If we then take a look at VAT, figures are more similar; 5.9% of the GDP in Latin-America and 6.8% of the GDP in OECD countries. It shows that OECD countries rely more on income taxes (OECD 8.3% of the GDP and Latin-America 2.2%), while in Latin-America we are more dependent on consumption taxes. I believe this is one of the main reasons why many countries in Latin-America are more advanced in terms of e-invoicing and invoice reporting.”

“This is also related to the fact that Latin-America suffers a very high tax evasion. The total amount of taxes evaded equals USD 335 billion or 6.3% of the GDP. Of this 2.3% of the GDP is related to VAT evasion, whilst the rest (4%) comes from income tax evasion.”

Could you explain the VAT system of Argentina?

“VAT was introduced in Argentina in 1973 and we have a VAT rate of 21%. This is one of the highest rates in Latin-America, only our neighboring country Uruguay has a higher VAT rate, whilst the average of Latin-America is 15%. There are also some reduced rates and on products such as milk and bread a 0% rate is applied.”

“VAT is very important for Argentina as it covers 32% of the total amount of taxes that are collected and it seems that this figure increases every year. This is also due to the widespread use of e-invoices. This was first introduced in 2005, but it was only made mandatory in 2016 for everyone. In the beginning there were only 971 companies that sent e-invoices, by 2018 this figure rose to 2 million.”

“The big advantage of making e-invoicing mandatory: it makes it easier to do checks. We can even perform audits with the smaller and bigger companies. The second big advantage is the ‘immediacy’, the information is real-time. This allows us to make risk analyses (CRM). The importance of e-invoices is aptly worded in a report by the CIAT about e-invoices[1], stating that e-invoicing has been a great help to Latin America. It was first introduced in Chile in 2003, afterwards Argentina, Mexico etc. So the main advantage is that it helps to fight evasion, but it also results in more transparency and even helps in fighting money laundry, financing of terrorism, corruption. For taxpayers themselves it also has many advantages: (1) way less paper is needed, (2) the costs of compliance is lowered and (3) it results in more certainty about the transactions.”

Although there are many advantages, I can imagine that companies complained about the introduction of the mandatory e-invoicing. Were there many complaints?

“Well, the process was very long, which helped. There were actually not that many complaints because at first e-invoicing was only meant for bigger companies and it was only optional. Afterwards it was gradually made mandatory. And sure, some mistakes were made in the beginning, but these were solved rapidly.”

“The bigger companies were even happy as they could now store all their documents digitally and send invoices via the internet. For the smaller companies it was a little bit different however as they were really used to just write out their invoices on paper. But again, the AFIP first made e-invoicing optional and then tried to support these companies where possible. For example, by creating an app that allows you to send the invoice from your mobile phone.[2] Overall, it is actually now way easier than before as all this paperwork belongs to the past.”

All of this results in better audits and thus less evasion, what type of VAT fraud still exists? In the EU there is the famous Missing Trader Intra Community Fraud, but what is the most common type of fraud in Argentina?

“The biggest problem in this regard are fake invoices, that serve to ask for VAT refunds. In essence the only thing fraudsters are doing is duplicating an invoice or creating a company that is non-existent. However, these schemes are getting more and more complex by the day, each time harder to detect. In general, fraudsters use existing companies, but issue invoices stating a way higher value than the goods they are actually selling. For example, a fraudster has a company here in Cordoba, but is issuing invoices as if it is doing business in Buenos Aires, in Amsterdam etc; instead of sending 10 invoices, I send 10.000 invoices. This type of companies we call mixed companies (empresas mixtas).”

Does the e-invoicing reporting system help in detecting this fraud?

“The thing is, what we have to do as a tax authority is to get to the fraudster as quickly as we can as it happens too often that when the fraud is detected the money is already stolen. I definitely think that our e-invoicing system helps in providing information more rapidly, it is a great advancement. We still have fraud today, but if the system was not there then there would have been way more fraud.”

You have written about digitalisation and are an advocate of the digitalisation of tax authorities, do you think this digitalisation within the tax authority could help in fighting fraud?

“Yes I do. A study of the IMF found that digitalisation enhances transparency. In turn, transparency is essential in fighting corruption and fraud. Besides, the digital gold is information and we can obtain this via electronic invoices to perform risk analyses. Another very important aspect of digitalisation is that it encourages cooperation. It helps to exchange information between different countries and tax authorities.”

“Important to emphasise is that the quality of this information should be good. Today, the tax authority is processing a lot of information, but we have to make sure the quality remains high. All these new technologies that are now being used, such as artificial intelligence and blockchain, work with a lot of data, but this data needs to be correct. For example, if the information of the tax authority says that Alfredo has a certain bank account, but it turns out that it actually belongs to Juan, then having information does not help.”

“So, I do think the usage of new technologies are very helpful in combating fraud, but we also need to keep investing in human resources as ultimately we work with people.”

This is related to a previous comment of yours that some taxpayer’s rights might be affected by this digitalisation, do you think confidentiality might be one of those?

“Yes, it is very important to respect the confidentiality of the taxpayer and to secure the used information. An example I used before to emphasise this point, is the case of Bulgaria. In 2019, there was a hack in Bulgaria that resulted in the leakage of information of 4 million taxpayers. It is fundamental to protect these taxpayer’s rights and therefore taxpayers need to be sure that the information that they are providing to the tax authority is secured and that they are informed about what happens with their information.”

“In Argentina, we did not experience a data breach such as in the example of Bulgaria. I want to add that I believe that almost every country is obliged to protect the rights of their taxpayers, but with the usage of new technologies we need to adapt to the new norm that these technologies set. For example, if I will be automatically checked by a system that uses artificial intelligence, I have the right to know how this system is actually checking me.”

Many countries in the EU are following the example of Latin-American countries with the implementation of real-time invoice reporting systems, what else can EU countries learn from Latin-America?**

“First of all, it is never good to generalise, or to say ‘this country is doing better than that country’. Furthermore, tax authorities should be very careful in taking over ideas of other countries and using technologies because other countries do; tax authorities should not implement such measures as if it were a fashion trend. Every country has its own characteristics and that requires different measures. So, if we say that the introduction of e-invoicing was a success in Argentina, we need to do research if the same would happen in another country. Still, if I need to mention one thing that other countries could learn from, this would be the widespread implementation of the e-invoice and the way VAT audits are performed.”

And what could Latin-American countries learn from countries in the EU?

“The EU has something that Latin-America does not have; that all countries are working together as a block. Sure, I know that there are many difficulties and differences, but it is a very good thing as it allows countries to work together and to increase transparency. Countries in the EU are also further in fiscal responsibility; there are rankings with companies that have a lower CO2 emission and that pay more taxes for example. Besides, there are forums where big companies and governments work together. These initiatives are not that common in Latin-America. So, the EU is further in terms of transparency and the digitalisation of the government.”

Do you believe that due to the current crisis VAT fraud will increase?

“Yes, as with any crisis fraud increases. As this might well be the biggest crisis in history, I expect that fraud will increase. Furthermore, the FATF[3] even warns companies about the increase in terrorist finance. The thing is, when there is a crisis, companies need money and the easiest way to obtain money is creating fake invoices and asking for refunds that do not correspond to the actual activity. So, I think that tax authorities need to be very careful. Also, when the crisis is over, in assessing which companies actually profited from the crisis.”

If you could give the European Union one piece advice in tackling VAT fraud, what would it be?

“My advice would be that (1) tax authorities should digitalise even further, (2) they should make e-invoicing mandatory in every country in the EU, (3) enhance the exchange of information between different tax authorities, (4) reduce the usage of cash as this is one of the most important causes for VAT evasion and (5) make use of new technologies, such as blockchain. What is essential for all of these advice is to study the actual causes of the VAT fraud committed; why is a fake invoice being created and what are the exact schemes that taxpayers are using to commit fraud?”

“Lastly, which is very important, citizens should be educated about the consequences of fraud. Fraud means less money for schools, hospitals and medical personnel. A study conducted by the ECLAC[4] is interesting in this regard. They found that to combat the crisis in Latin-America an investment that equals 4.3% of the GDP is needed. As I mentioned earlier, an amount equivalent to 6.3% of the GDP is lost in Latin America due to tax evasion. Thus, if this evasion is caught, we will have plenty of money to overcome the crisis. That’s why I think that especially now, it is really important to fight fraud.”

Lastly, what do you have to say to the reader to enthuse them about VAT?

“What I want to say to people that think that taxes are boring, is that if you look closer and see what the taxes are used for, you’ll see that it is used for building schools, hospitals, public services, to financing crises like Covid-19 and strengthen the rule of law, so taxes are very important in our lives, they are not boring.”

We would like to thank Alfredo again for his time and for giving his perspective on VAT. If you have any questions, suggestions or if you want to be our next interviewee, do not hesitate to contact us via info@summitto.com. If you want to read more of Alfredo’s work, visit https://www.ciat.org/team/alfredo-collosa/?lang=en

-

Read the report here: https://publications.iadb.org/publications/english/document/Electronic-Invoicing-in-Latin-America.pdf

-

Have a look at the app here: https://www.afip.gob.ar/facturadormovil/