Introduction

The Organisation for Economic Development Cooperation and Development (OECD) recently published a report about e-invoicing. The aim of the report is “to set out some of the core elements of existing “electronic invoicing” systems, and to draw “out some considerations for those exploring possible implementation or reform of such systems”. In the following we address some key findings of the report and will provide our analyses.

Getting the definitions straight

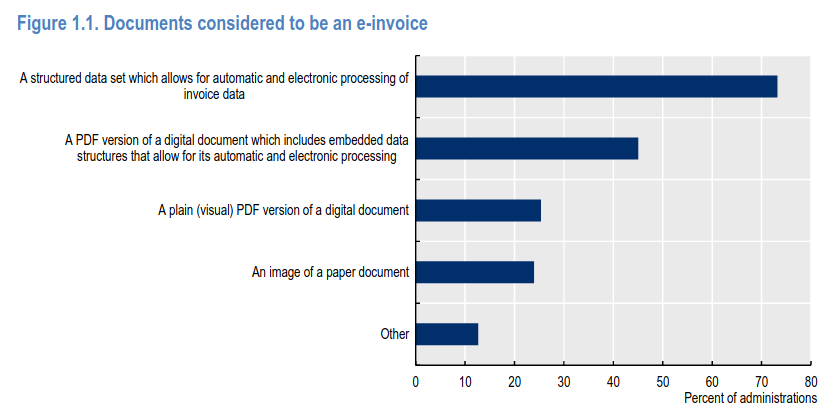

We have stressed it quite often, for example here, e-invoicing is something different than real-time reporting. Besides, e-invoicing itself is exchanging invoices between companies in a structured, automated way. An interesting finding of the report is that many tax authority officials are unfortunately not yet aware of this. Around 25% consider a plain PDF version of a digital document an e-invoice, while more than 20% believe an image of a paper document is also an e-invoice.

Figure 1: what is an e-invoice?

Source: OECD

Besides the definition of an e-invoice, there is also the question: what does an e-invoicing system mean? The OECD report states that here “the EU report [1] distinguishes between two types of continuous transaction reporting (which it terms real-time reporting and e-invoicing).” This is getting close to what we believe is the optimal definition. One important difference is that we would categorise it as: real-time reporting and real-time reporting WITH e-invoicing because e-invoicing itself does not imply reporting to the tax authority as mentioned above. Therefore it is problematic that the OECD says that “in this report both these types of continuous transaction reporting are termed electronic invoicing”. One reason why we argue this is problematic, is that it is extremely important to have clear and correct definitions in order to be able to exchange knowledge between tax authorities. This is especially true for an influential organisation such as the OECD. The discussions held in the dedicated working groups can really help to further harmonise real-time reporting systems, and e-invoicing standards across the world. However, then it is essential that all participating members know that e.g. an e-invoicing standard is not inherent to real-time reporting.

Reasons why tax authorities want real-time reporting

In another section the report discusses why OECD members are speaking about the implementation of real-time reporting. The most important reasons are:

- To support the implementation of a sustainable e-business ecosystem

- Digitalising the domestic regulatory invoicing framework

- Enhancing overall compliance risk management effectiveness

- Taxpayer service innovations

It is interesting to see that these different reasons seem to be equally important for the tax authorities, whereas often closing the VAT gap is mentioned as the most important reason. In order to bring the discussion further, countries could put more emphasis on these additional benefits of real-time reporting as well. A great example is of course offering pre-filled VAT returns, but the digitalisation of the entire invoicing process is another excellent reason to implement real-time reporting (with or without e-invoicing).

How are invoices reported to the tax authorities?

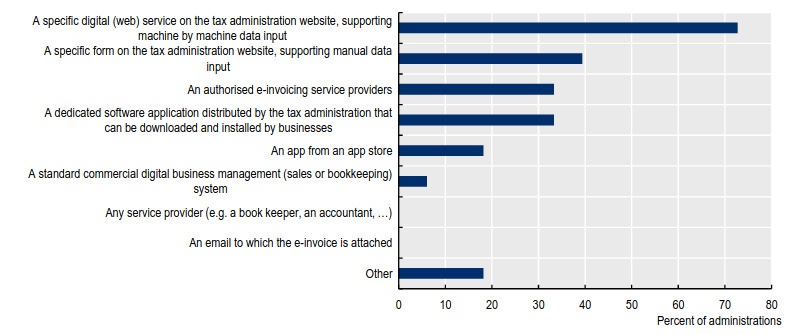

The report also gives an overview of how invoices are reported to tax authorities. Note that several tax authorities offer multiple options. Over 70% of the tax administrations allow for reporting via a digital (web) service, which also supports machine by machine data input. Thus, this allows for automating the reporting process. Other popular options are (1) a webportal only supporting manual data input, (2) an authorised e-invoicing service provider or (3) a dedicated software application distributed by the tax administration that can be downloaded and installed by businesses. In order to make an even more informed decision regarding how companies should report their invoices, additional research can be done in the experience of companies with different ways of reporting. This can help in choosing the optimal solution.

Figure 2: How are invoices reported to the tax authority

Source: OECD

Key factors of a successful real-time reporting implementation

Related to the above: what are the key factors to a successful real-time reporting implementation? According to the report these are:

- Communication and consultation with external stakeholders, in particular with respect to costs and benefits, technical requirements and implementation scheduling.

- Legislation regarding, among other things, the adoption strategy, standards and data security and privacy.

- Design of data exchange architectures, including the semantical and technical specifications of standards, the role of software and data reporting service providers and tax administration services.

- Tax administration capabilities in terms of compliance risk management, data security and IT-infrastructure deployment.

Two relevant sidenotes: definitions and data protection

All in all this OECD report gives an excellent overview of what policy decisions countries have taken regarding the implementation of real-time reporting. However, there are two problematic aspects of the report. The first aspect was already discussed above and concerns the lack of clear definitions. This is essential for any harmonisation effort to become successful.

The second problematic aspect is that data protection is only very briefly discussed. As we have explained many times, the protection of invoice data is extremely important. When falling in the wrong hands, it can have devastating consequences both for individuals as for the economy as a whole. Therefore, it would be positive if the OECD would also discuss this aspect and advocate a privacy-by-design approach. This means that data protection is taken into account from the very start of designing a new real-time reporting system. One approach is the application of modern encryption, which allows the tax authority to close the VAT gap without storing any sensitive data.

In case you want to know more about our periodic or real-time reporting solutions have a look at our website at www.summitto.com or do not hesitate to contact us at info@summitto.com.

[1] https://op.europa.eu/en/publication-detail/-/publication/818e4799-0967-11ed-b11c-01aa75ed71a1