Last week, we made our pilot programme publicly available which allows anyone with a computer to report invoices to summitto’s real-time reporting systeem. We already briefly discussed how the pilot works in a previous blog post, but in this blog post we will provide some more detailed information on how to use the pilot!

Why is summitto’s real-time reporting also relevant for you?

More and more countries are implementing real-time reporting systems to close the VAT gap and streamline business processes. Recently two influential EU Member States have joined the group of countries that decided to introduce a real-time reporting system: France will strate with real-time reporting in 2023, while Poland is planning to introduce their system already this year (at first in a voluntary manner). We predict that more and more EU Member States will follow their lead during the next couple of years, because of the excellent results this tool achieved in many countries all over the world.

The fact that the European Commission is now investigating real-time reporting for intra-Community transactions makes this prediction even more plausible. Once such a European system is in place, it would be most efficient for EU Member States to implement a real-time reporting system for domestic transactions as well. This would allow companies to adjust their IT processes in such a way that their reporting standards for both domestic and intra-Community transactions can be automated in the same system.

In other words, this pilot is relevant for everyone dealing with VAT because there is a high change that 2021 will be the year that real-time reporting is coming to your country as well.

Registration and login

The first thing you should do is go to: https://portal.summitto.com/

Here you can watch an explanatory video and learn more about our pilot. The pilot is meant to show how reporting invoices will look like in general or later for smaller companies and the self-employed when summitto’s real-time reporting system is introduced by a tax authority.

Important to emphasize is that for most companies the process of invoice reporting could be fully automated by coupling their accounting software or ERP system.

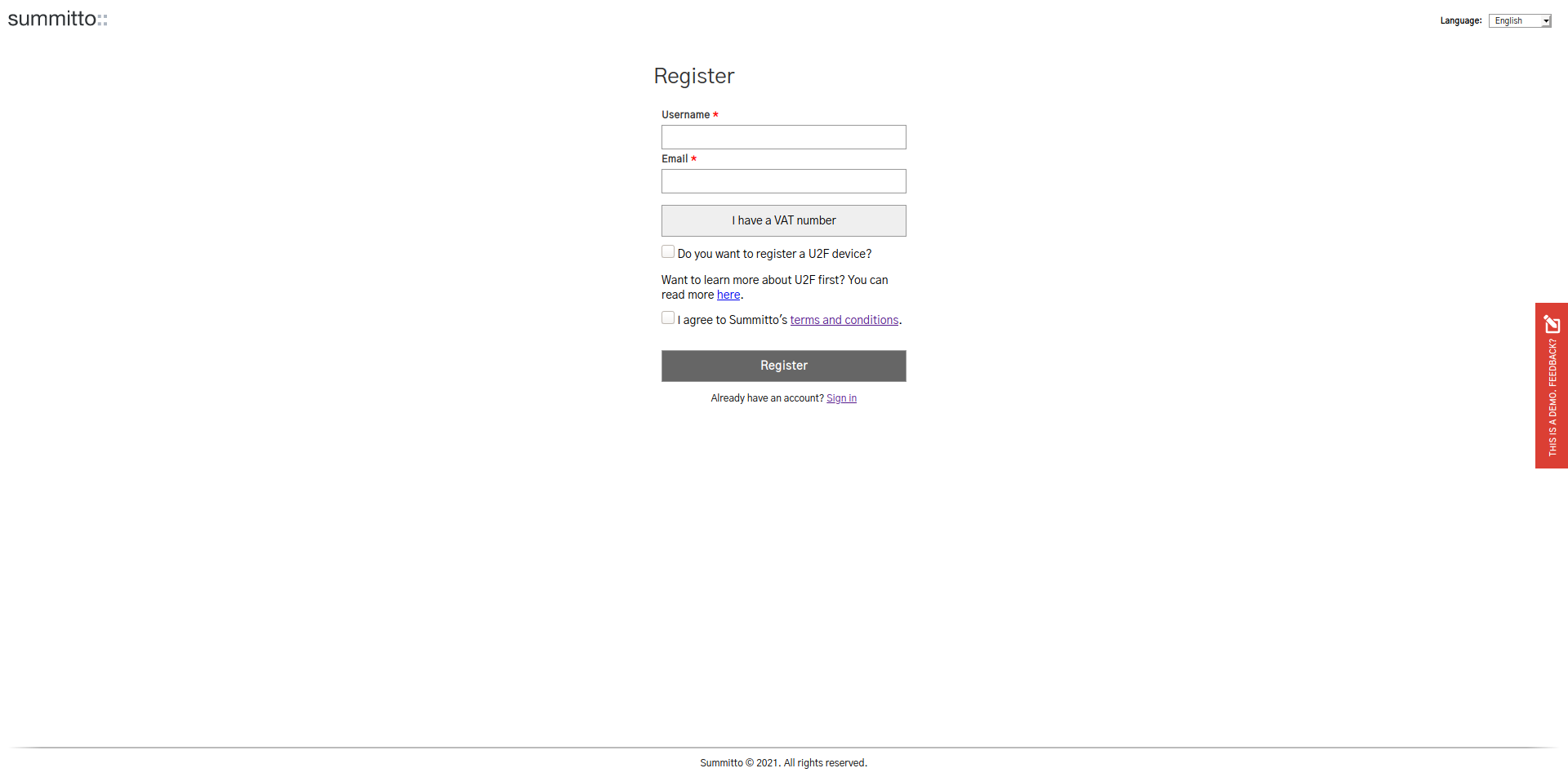

The webpage also shows what the exact advantages are of real-time reporting. All the way down, you can find your way to the registration portal (Figure 1). Here you can pick the prefered language in the top right corner. The pilot currently supports Dutch, English, French and German. By filling in the registration form, an account will be created.

Figure 1: Registering for summitto’s pilot

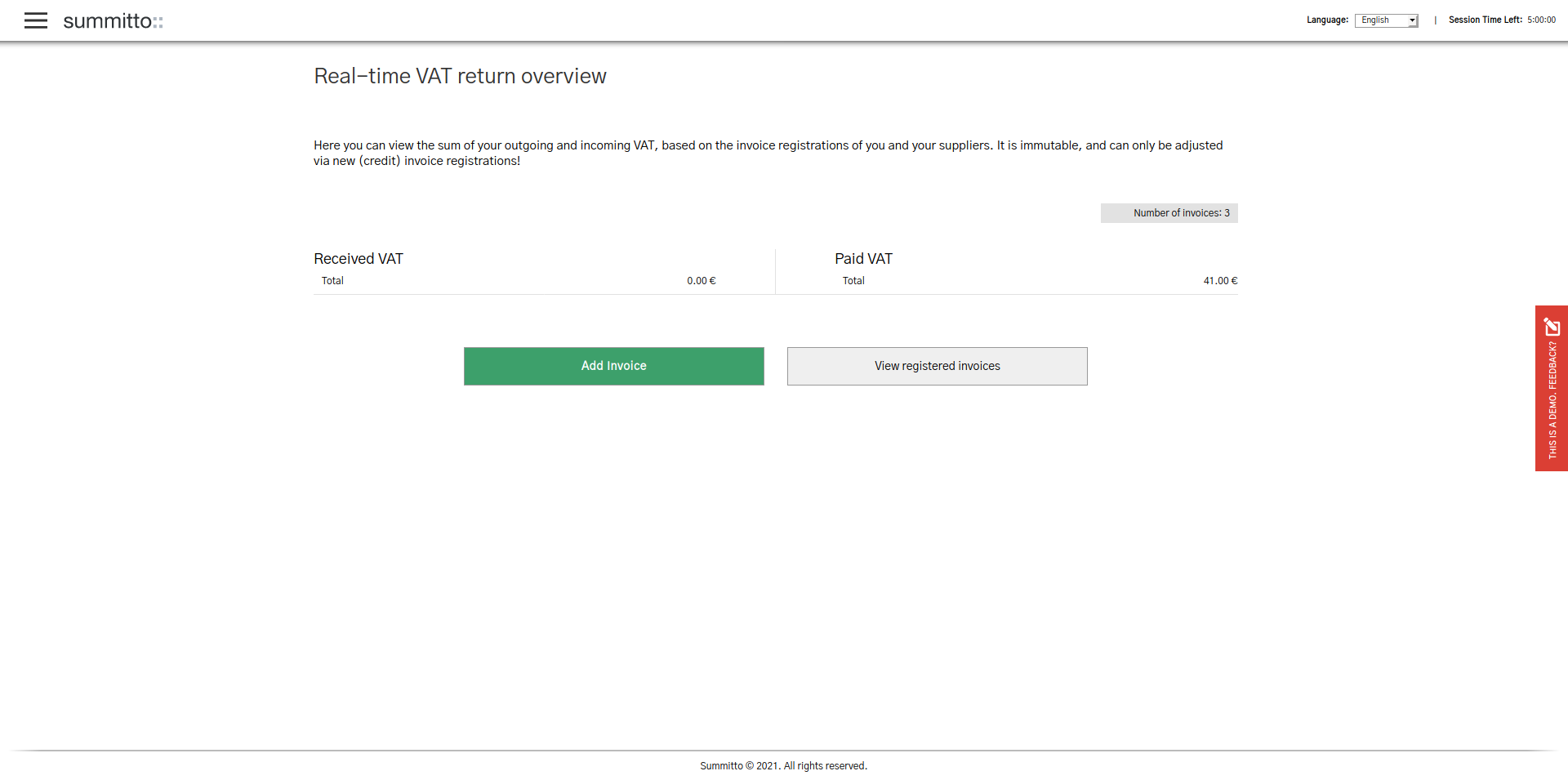

How to register an invoice Once the registration is successful and you have received your login details, you can login. At the home page (Figure 2) you can see your VAT return, in real-time. By clicking on the big green button you can start reporting invoices! When adding an invoice, make sure to use ‘NL’ when typing in the ‘Buyer VAT number’. Another option is to upload a Factur-X or ZUGFeRD invoice. This is the german-french e-invoicing standard, which elegantly combines XML and PDF thus creating an invoice that can be both read by humans and computers. The rest of the invoice reporting process is fairly straightforward.

Figure 2: Real-time VAT return overview

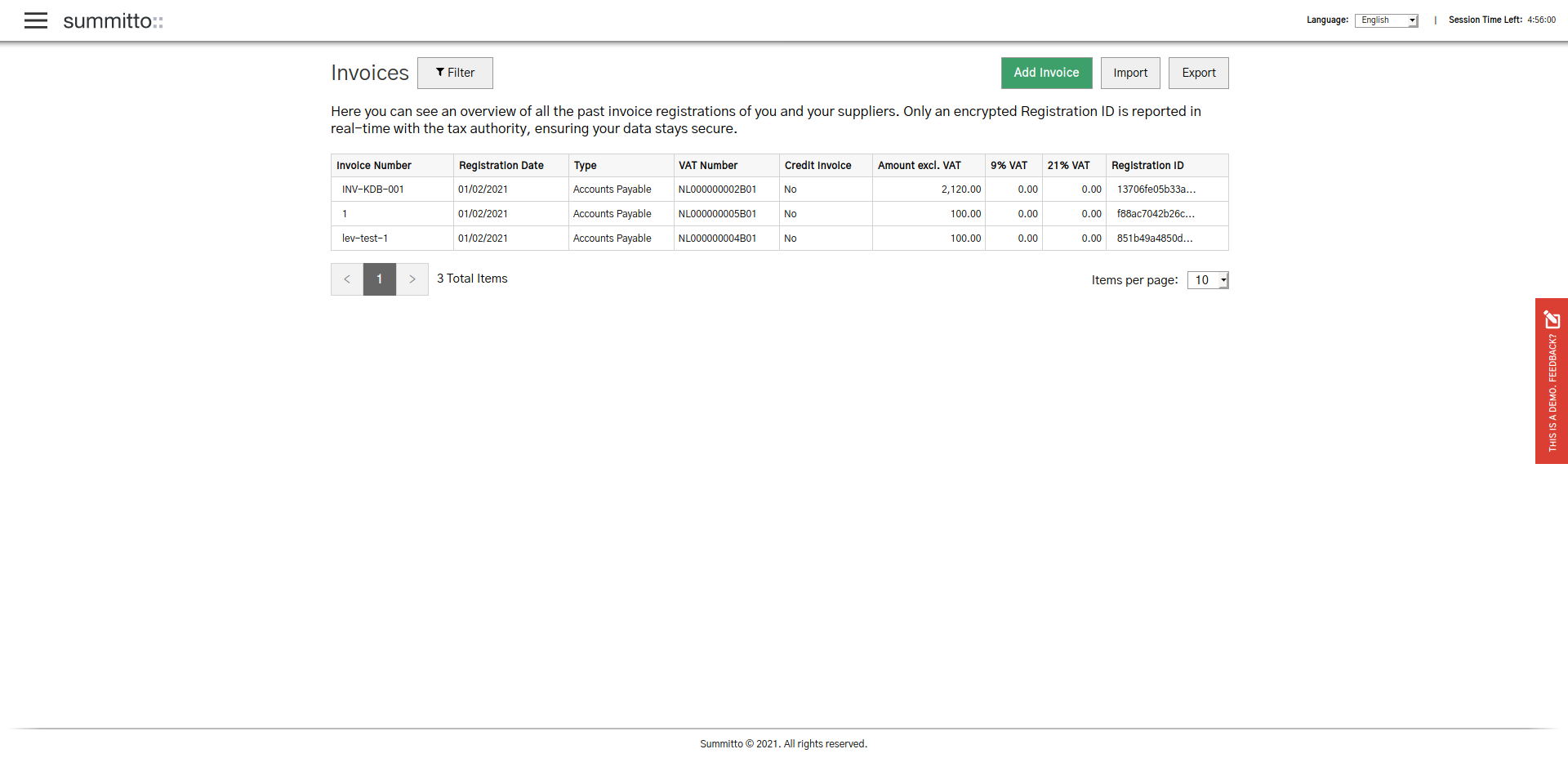

After adding the invoice, you can view the invoices you have registered by clicking on ‘View registered invoices’. Here you can see all the invoices you have registered before (Figure 3). You see e.g. your invoice number and the registration date. A number that might be a little bit confusing to you is the ‘Registration ID’. This Registration ID is a fully encrypted fingerprint of the invoice and it is the only thing the tax authority will be able to see. In a previous blog post we explained how it is possible that even without seeing the actual invoice data, VAT compliance can still be increased. Additionally, this fingerprint will be made publicly available which enables companies to mathematically prove that they have used their invoices for VAT purposes. This creates a single source of truth for invoices and allows companies to automate their audits, or provide real-time revenue information to their investors. You can read more about the idea of verified financial information here.

Figure 3: Invoice overview

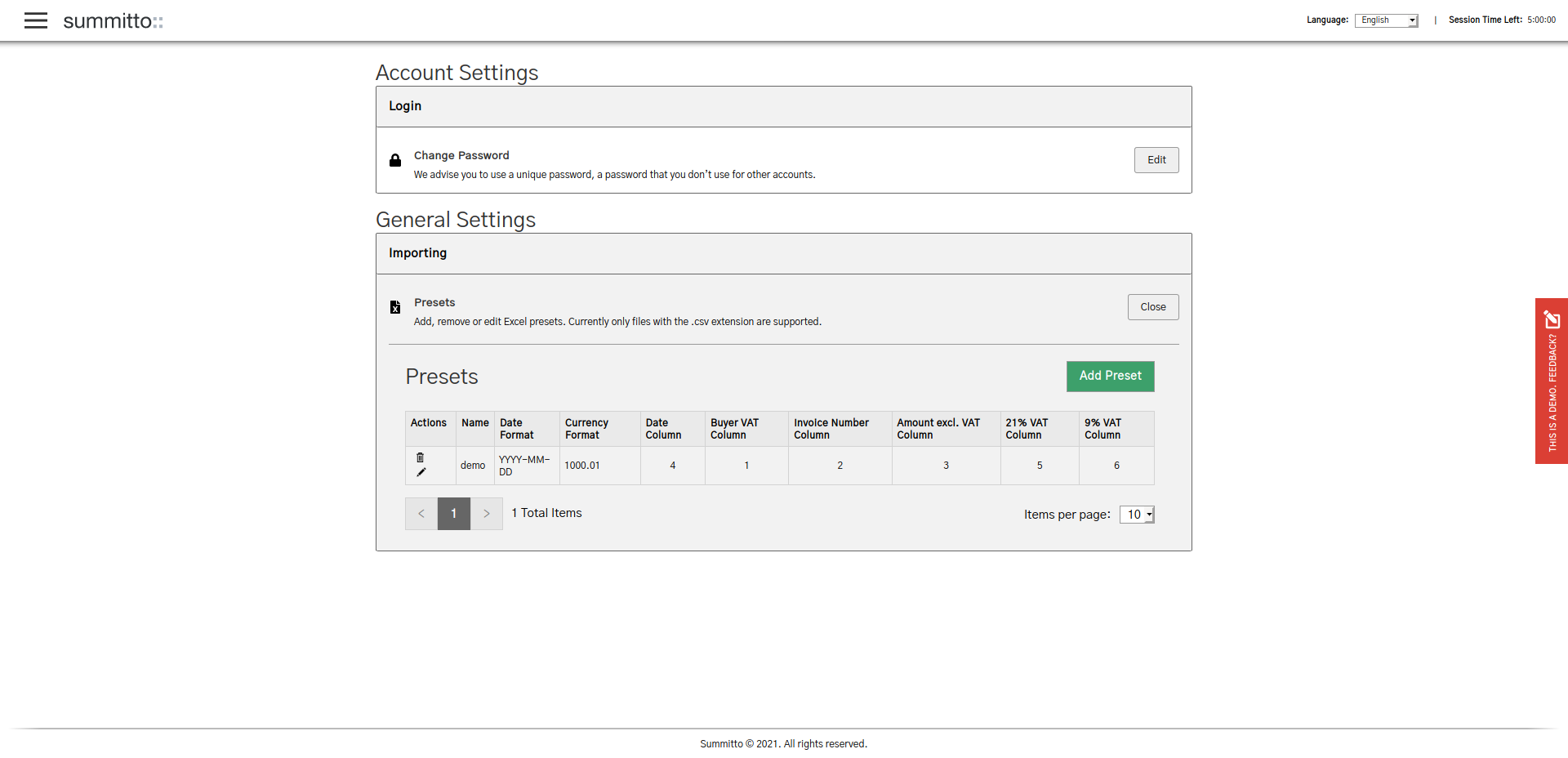

Importing an Excel file Imagine you have created multiple invoices in a day and do not use an ERP system or similar accounting software you might want to register multiple invoices at once. Therefore it is also possible to import a batch of invoices via a CSV file (read how to save an Excel file as a CSV file here). Before doing that you need to make sure that the reporting system is able to read your file correctly. Therefore, the right preset is necessary. You can add or adjust presets by clicking on ‘Settings’ in the top left menu. Under ‘General setting’ you can then add the preferred preset (Figure 4).

Figure 4: Setting a preset

To actually import an Excel file, go to “Invoices” via the menu button. This leads you again to the invoice overview (as shown in Figure 3). Now, click on “Import”, select your preferred preset and upload a CSV file.

Now you know everything about summitto’s real-time reporting pilot!

In case you want to learn more about how summitto’s real-time reporting system exactly works and how it benefits both the public and private sector click here. For questions, shoot us a message at info@summitto.com