Introduction

Recently the European Parliament published an excellent report discussing how to improve the exchange of information and compliance to reduce the VAT gap. In the following we will provide an overview of the main findings and analyse the conclusions made in the report. We’ll start by discussing the size of the current VAT gap and the amount of VAT fraud committed on an annual basis.

At least €50 billion in VAT fraud every year

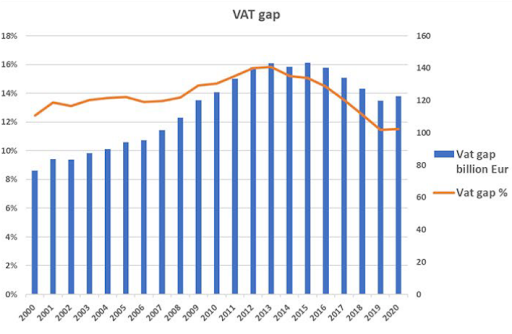

The report rightfully states that it’s difficult to estimate the VAT gap “as by definition it involves the estimation of unobserved variables, such as the compliance rate.” According to estimates of the European Commission over the last couple of years the VAT gap decreased thanks to “the effort undertaken during and after the sovereign debt crisis to improve public finances and to improve tax collection.” As shown in Figure 1 the VAT gap has been decreasing since 2015 towards just below €120 billion. However, a stagnation can be observed due to the COVID-19 crisis. Furthermore, the negative economic impact of that same crisis, sparked new interest to really reduce the VAT gap.

Figure 1: the EU VAT gap

Source: Jérôme Saulnier with Maria Mercedes Garcia Munoz (2021)

A big share of this gap is due to fraud. Just as with the VAT gap, it’s difficult to measure the amount of VAT fraud committed. The report compares three different approaches to get to an average of €52 billion of VAT fraud for 2020. This is an enormous amount of money that is being lost. However, there are also “a whole range of indirect costs that are not necessarily reflected in econometric evaluations. Some businesses might fall victim to VAT fraud on a large scale, sometimes under the umbrella of organised crime organisations.” Therefore, it’s extremely important to reduce this type of fraud.

VAT compliance costs in the EU

It’s important to tackle this type of fraud in a way that the costs of VAT compliance do not increase. Especially when taking into account that compliance already provides quite a challenge to EU businesses. The report states that: “European Commission surveys constantly report that the current EU tax system and in particular VAT is one of the main administrative challenges for businesses, both in terms of its complexity and in terms of the burden of compliance that it imposes.”

Some statistics provide a clear picture of the VAT compliance costs:

- VAT data collection costs represent 57% of tax compliance costs on average, against 44% for corporate income tax.

- It currently takes 9 hours for an average EU business to comply with VAT refund and more than 17 weeks to obtain a VAT refund.

- Compliance costs have only slightly declined between 2014 and 2020, from 3.65% to 3.45%.

Potential policy scenarios

So, how to reduce the VAT gap without increasing the compliance cost? The report lays down four different scenarios to achieve this goal. In the following we will explain the different scenarios and subsequently provide our views on these scenarios. Hint: it’s about real-time reporting!

Baseline scenario

In the baseline scenario, no significant change will be made to the current VAT system. According to the estimations in the report this will result in a very small decrease of the VAT gap between 2020 and 2025 of a bit more than €3 billion. From €120 billion in 2019 to €116 billion in 2025. Furthemore, the compliance costs for business can further increase by almost €1 billion, from €31 billion in 2019, to €32 billion in 2025.

First alternative scenario

In this scenario, substantial progress will be made. For example, the collaboration between Member States will be extended through enhanced information exchange by accelerating the usage of TNA. Furthermore, mandatory e-invoicing is also discussed as a policy option in this scenario. Together with the further digitalisation of the tax authority, this scenario would result in a €29 billion reduction of the VAT gap and a reduction of almost €10 billion in compliance costs for businesses.

Second alternative scenario

The second alternative scenario corresponds to the progressive implementation of the definitive VAT regime and to the OSS coming into full gear. The report states that this scenario results in a reduction of €35 billion, of the VAT gap, and a reduction of almost €10 billion in the compliance costs for businesses.

Third alternative scenario

The last scenario is the “most ambitious scenario” according to the report. It includes an EU treasury, the implementation of Qualified Majority Voting (against the current veto-system) and a VAT administered at the EU level. The authors acknowledge that this scenario is “extremely unlikely at this stage”, but that it is worth exploring. The potential result would be a €57 billion reduction of the VAT gap and a €14 billion reduction in the compliance costs.

Interpretation of the report

Real-time reporting

First and foremost it’s important to emphasise that we welcome this excellent research into the VAT gap which provides some excellent policy options. However, we believe that mandatory e-invoicing is not sufficiently addressed as it only discusses the invoice clearance model, omitting different models that can achieve the same result. Furthermore, the importance of this policy option seems to be undervalued. First, the predicted reduction of the VAT gap in the scenario where real-time reporting is implemented is rather small. For example, Italy managed to reduce its VAT gap by €10 billion in two years after the implementation of the Sistema di Interscambio.[1] Therefore, it can be expected that such a solution on an EU wide scale might result in a higher reduction of the VAT gap than €29 billion.

This does not need to have a negative effect on compliance as stated in the report: “our analysis shows that new obligations imposed to fight tax fraud and reduce the VAT gap do not necessarily increase compliance costs if they are accompanied by progress in digitalisation and in reducing complexity, while ensuring that the tax administration is effective and transparent and robust enforcement of the rule of law.” When properly implemented real-time reporting allows for the automation of many business processes, pre-filled VAT returns and also faster VAT payments. Therefore, the compliance costs can also be expected to go down even further than the €10 billion mentioned in the report.

Definitive system

It is argued that with the implementation of the definitive system the VAT gap can be closed to an even further extent. It’s worth emphasising that this is only true when coupled with real-time reporting, because without real-time reporting, the definitive system would spark new types of VAT fraud as explained by Prof. Dr. Marie Lamensch. Additionally, the functioning of the system depends to a high extent on collaboration between Member States. In the definitive system, when VAT is reported in Member State A, it should be reported to Member State B which could create enormous tensions. We previously explained how confidential real-time reporting could solve this problem.

Conclusion

The discussed report clearly shows that reducing the VAT gap is high on the political agenda of the European Parliament. It is an especially relevant debate given the negative economic impact of the COVID-19 crisis. In order to reduce the VAT gap without increasing VAT compliance costs, the report offered several scenarios. Our take is that not enough emphasis is put on real-time reporting, which proved in many cases that it can significantly reduce both VAT fraud and the administrative burden. In this discussion it’s important to emphasise that there are different ways to implement such a model, which is not discussed in the report. Finally, we explained the need for real-time reporting to make the definitive system a success and actually achieve the results that were predicted in the report.

In case you want to learn more about how summitto’s real-time reporting system exactly works and how it benefits both the public and private sector click here. For questions, shoot us a message at info@summitto.com

[1] Italian Ministry of Finance, Relazione sull’economia non osservata e sull’evasione fiscale e contributiva (2021) https://www.finanze.it/export/sites/finanze/.galleries/Documenti/Varie/Relazione-evasione-fiscale-e-contributiva_25_09_finale.pdf