On September 10th the European Commission published its annual VAT gap report. The report shows that the European Union Member States lost a total of €140 billion in VAT in 2018. Even more worrisome is the forecast that those same Member States will lose a total of €164 billion in VAT over 2020 due to the COVID-19 pandemic. Luckily there is also positive news as Commissioner Gentiloni is planning to ‘step up the fight against VAT fraud’.[1] In this blogpost, we will first discuss the key takeaways of the VAT Gap report of the European Commission, after which we analyse what is being done to close this gap and show how summitto can help to achieve this goal.

€164 billion lost in VAT

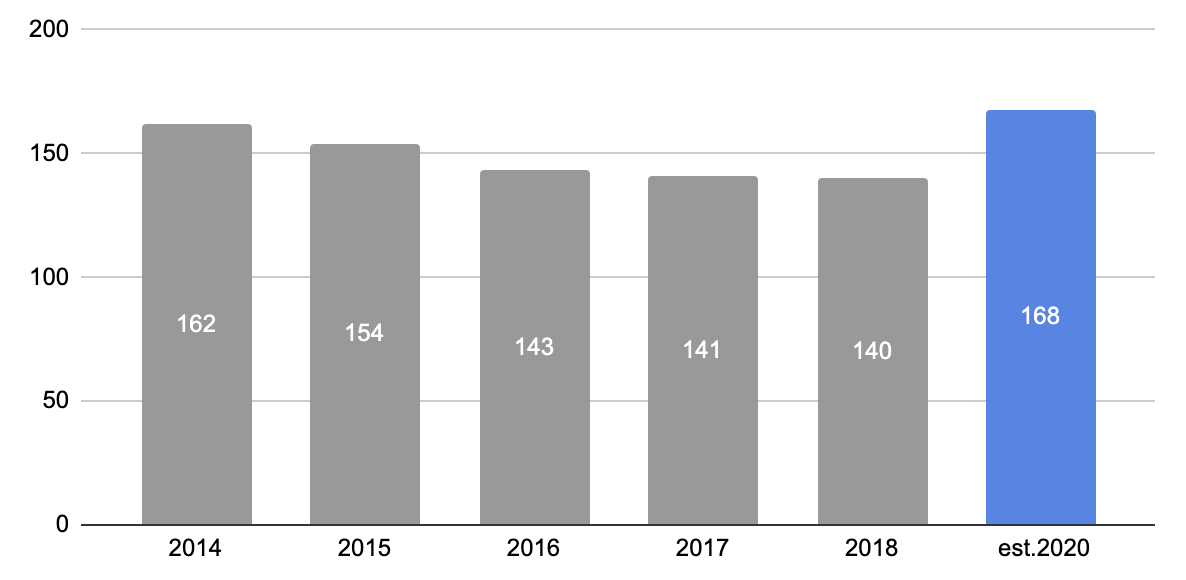

Over the last couple of years due to the measures of Member States and the European Union, the VAT gap gradually decreased (see figure 1). Still, the massive amount of €140 billion in VAT was lost in 2018. Furthermore, the report forecasts that despite the hard work, the COVID-19 pandemic will throw us back to the year 2014 where €160 billion in VAT was lost: it is expected that in 2020 the VAT gap will be €164 billion. Before diving into the measures that are planned to close this gap (both on the national and the european level), we analyse the key figures for 2018 that are discussed in the latest VAT gap report:

-

The European Union wide VAT gap is 11% of total VAT revenues.

-

There is a wide variety of VAT gaps between Member States, VAT gaps range from 1% in Sweden to 33.8% in Romania.

-

The largest nominal gaps were recorded in Italy (€35.4 billion), the UK (€23.4 billion) and Germany (€22 billion).

-

The VAT gap decreased in the majority of Member States (21) and only increased in 7.

-

The VAT gap could increase to €164 billion in 2020.

Figure 1: The VAT gap 2014-2018 in € billions

Source: European Commission (2020)

Source: European Commission (2020)

Measures to tackle the VAT gap

These huge losses are especially troublesome during the pandemic, as government revenues are urgently needed for economic recovery. Luckily there are different (planned) measures that aim to tackle the problem.

Measures on the European Union level

An important policy package to reduce fraud that will go into force in July 2021 is the VAT e-commerce package.[2] This legislation, among other things, removes the VAT exemption on imported goods with a value below €22, which was often used by malicious companies to commit fraud. Another noteworthy development is the increased cooperation between Eurofisc[3], Europol[4] and OLAF[5]. This allows Member States to exchange information more efficiently, which is essential in fighting VAT fraud as according to VAT Professor Redmar Wolf ‘VAT fraud is a timing-issue’.[6] Maybe even more important than the above mentioned measures, was the publication of the ‘Package for fair and simple taxation’ in July 2020. Fighting VAT fraud and closing the VAT gap is a central aspect of this package of the European Commission.

First of all, the European Commission shows its interest in the usage of technology by tax authorities to fight VAT fraud. The European Commission states that the conference VAT in the Digital Age (where summitto had the honour to present its solution[7]) organised in December 2019 ‘highlighted the need to deepen the reflection in this area’.[8] Related to this are the proposed VAT reporting measures. The European Commission notes that ‘Member States are already employing new technologies in order to obtain quicker and/or more detailed information on domestic transactions’. Therefore, the European Commission plans to present a proposal for ‘modernising VAT reporting obligations in 2022/23’. This proposal could help to significantly reduce fraud.

Measures on the Member State level

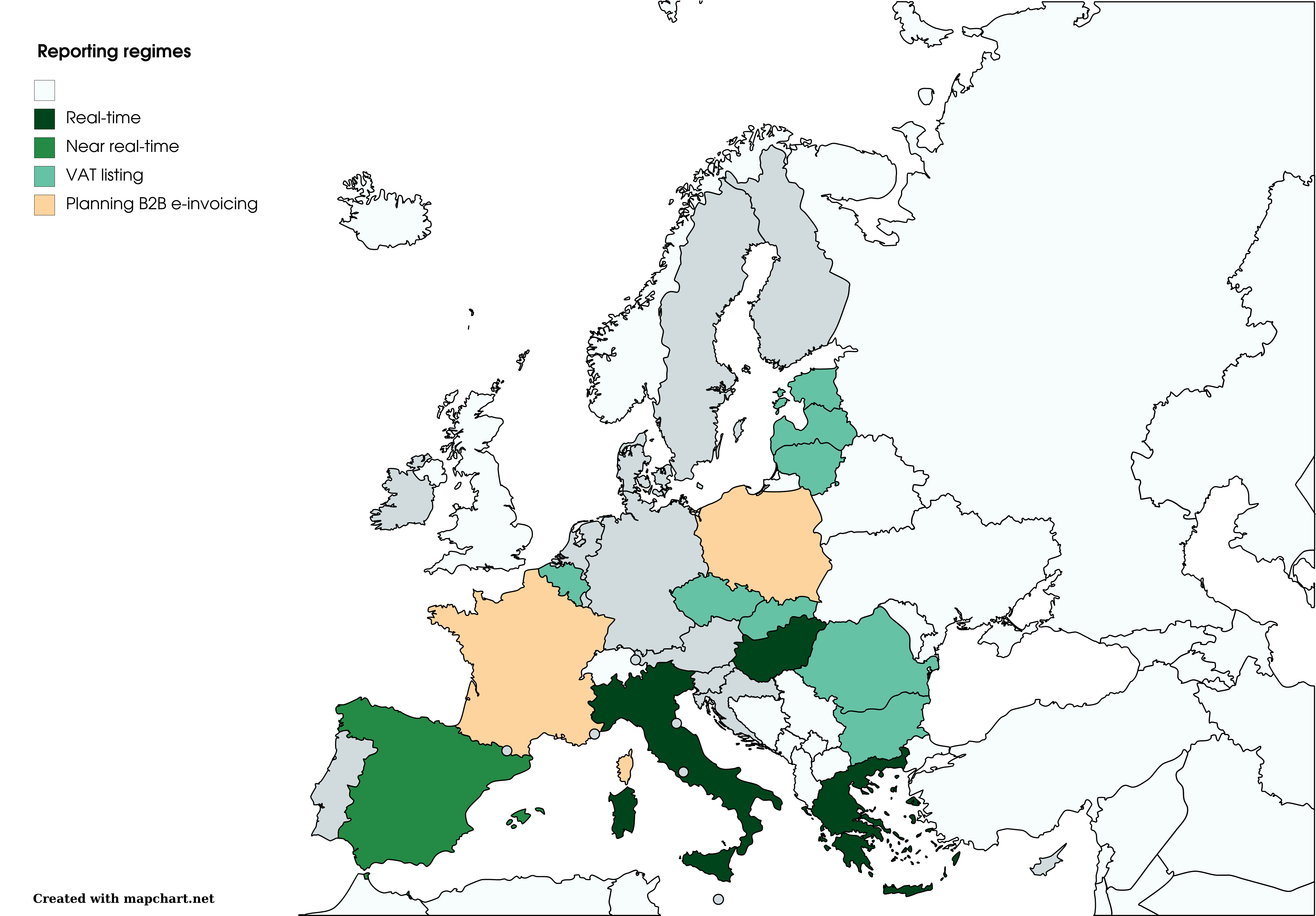

The European Commission is absolutely correct that Member States are currently making use of technology themselves to combat VAT fraud. This has created a varying landscape of reporting regimes throughout the European Union (see figure 2). Let’s have a look at some of the different reporting regimes:

-

Spain introduced their Suministro Inmediato de Información (SII) in 2017. This regime requires companies with a revenue of €6 million or higher to report their billing records within 4 days after issuance. This is often called a near-real-time reporting system.[9]

-

Hungary introduced its real-time reporting system in 2018, which means that VAT registered companies in Hungary have to send an electronic declaration of the B2B invoice data to the tax authority, if the value of that invoice exceeds a certain threshold.[10]

-

The Italian Sistema di Intercambio (SdI) that was launched in 2019, is similar to the Hungarian real-time reporting system. Both are real-time, so the invoice needs to be sent to the tax authority at the moment of issuing the invoice. The main difference is that the Italian system comes with mandatory e-invoicing. Furthermore, the tax authority first clears the invoice before it is sent to the buyer. This makes the SdI an invoice approval portal.[11]

-

France is currently planning to introduce mandatory e-invoicing coupled with a reporting regime at the earliest in 2023. However, they are still analysing which reporting regime is most appropriate.[12]

Although there are other measures taken by different Member States, we mainly want to show that there is a trend within the European Union to develop real-time reporting systems by individual Member States.

Figure 2: VAT reporting landscape in the EU

Source: created with mapchart.net

A confidential solution to close the VAT gap

Although we believe VAT reporting is the best solution to recover billions of euros in VAT, the flaw that is apparent in all those different systems is that they do not guarantee the confidentiality of the taxpayer. Such systems require taxpayers to send a lot of data to the tax authority, which is often available in clear-text to the officials that are responsible for the analysis of those invoices. This makes them very vulnerable to cyber attacks. This is especially relevant for invoice information. When pricing information is exposed ‘you could see that a supplier is charging different prices for the same goods to different business partners’, as Zsolt Szatmari, managing senior of the VAT knowledge group at the IBFD, told us.[13]

As we have explained in a [previous blogpost][], in order to close the VAT gap and guarantee the confidentiality of the taxpayer, we have developed a confidential real-time reporting system. By using modern cryptography, we are able to achieve the same results as any other real-time reporting system without storing any valuable invoice information. Additionally, we will make this solution open-source, which means that once one Member State has implemented confidential real-time reporting, the same system can be easily rolled out in other Member States as well. This strengthens the European Single Market and will make it easier for companies to comply with VAT regulation.

Conclusion

Due to the current pandemic it is expected that the VAT gap will increase with ~17% in 2020 towards €164 billion. This makes it even more relevant than before to take action now. We support the increasing endeavors of both the European Union and the Member States to tackle the problem head-on, but we see room for improvement and harmonisation. Current VAT reporting systems do not guarantee the confidentiality of the taxpayer, which is especially important when dealing with invoices that contain pricing information. Summitto’s confidential real-time reporting system does guarantee this confidentiality by making use of modern technology. Furthermore, by open-sourcing our solution we will make it available for every Member State within the European Union to strengthen the European Single Market.

[1] https://ec.europa.eu/taxation_customs/business/tax-cooperation-control/vat-gap_en

[2] https://ec.europa.eu/taxation_customs/business/vat/modernising-vat-cross-border-ecommerce_en

[4] https://www.europol.europa.eu/

[5] https://ec.europa.eu/anti-fraud/home_en

[6] https://blog.summitto.com/posts/vat_talks_redmar_wolf/

[7] See our presentation from 01:24:30 here: https://ec.europa.eu/taxation_customs/events/vat-digital-age_en

[8] https://ec.europa.eu/taxation_customs/sites/taxation/files/2020_tax_package_tax_action_plan_en.pdf

[10] https://taxbackinternational.com/blog/hungary-real-time-reporting/

[11] https://www.avalara.com/vatlive/en/country-guides/europe/italy/italy-sdi-real-time-e-invoices.html

[12] https://www.pagero.com/news/mandatory-e-invoicing-france/

[13] https://blog.summitto.com/posts/vat_talks_zsolt_szatmari/