Introduction

“VAT fraud is a timing-issue” as VAT Prof. Dr. Redmar Wolf said in one of our previous blog posts. Therefore, it is essential to rapidly exchange VAT data between Member States. Several obligations, systems and institutions were put into place to realise this rapid exchange of data. The wide variety of tools resulted, as often happens in the VAT world, in many abbreviations. In the following we will try to provide some clarity regarding: the VAT Information Exchange System (VIES), Intrastat, Eurofisc and the Transaction Network Analysis (TNA).

VIES: exchanging VAT registration and intra-Community supply information between Member States

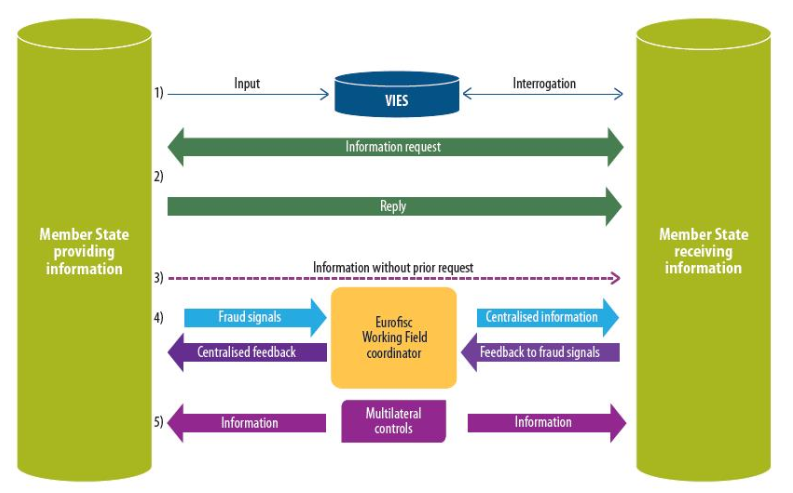

Figure 1 provides an overview of how the VAT data exchange between Member States is organized (correct, Intrastat and TNA are not included in the picture, but we’ll get to those later). All the way at the top of the figure you can find VIES. VIES is an electronic system which has two main functions. First, it allows Member States to exchange data regarding VAT registered entities and their intra-Community supplies. Second, it enables companies to check the VAT number of their business partners. In fact during an intra-Community supply, the supplier needs to add the VAT number of the buyer, which can be verified in VIES. The VAT number information included in VIES stems from a direct connection with the national databases of the Member States themselves.

Figure 1: VAT information exchange by EU Member States

Source: ECA

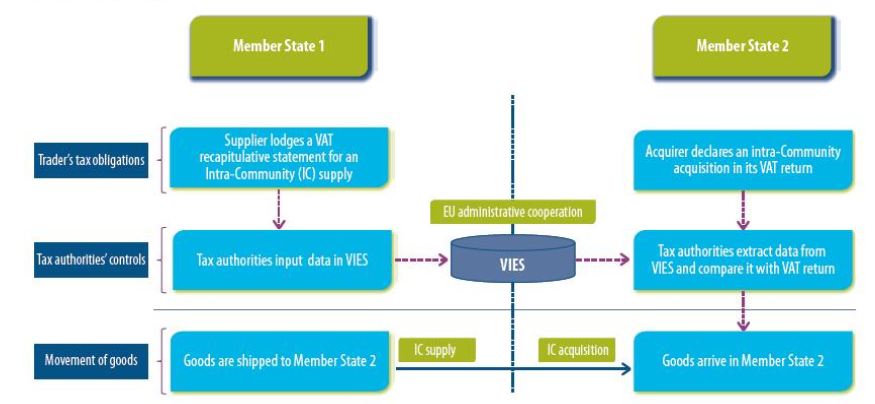

Information of intra-Community supplies on the other hand comes from the recapitulative statements which businesses have to report when doing intra-EU supplies. These statements list the aggregate value of supplies of goods and services made to VAT registered customers elsewhere in the EU. Member States’ tax administrations use and exchange among each other this data to ensure that intra-EU VAT has been correctly accounted for (see Figure 2 for a visualisation of how VIES works).[1] This information can be exchanged automatically. A different type of information is provided by Member States through the Intrastat declaration, which is collected for statistical purposes.

Figure 2: How VIES works

Source: ECA

Intrastat: information for statistical purposes

Under certain conditions, next to the recapitulative statements, companies also need to file Intrastat reports. The data that needs to be reported is quite similar to the recapitulative statement previously discussed, but the original purpose of the Intrastat report is different. The data used to serve exclusively for statistical purposes. All data was sent to Eurostat and the national equivalents of this statistical institution. In general this data is not used for fraud investigation purposes, as tax authority officials told us. However, certain sources state that as of recently the data is more often used for fraud investigation purposes as well.[2]

Together with the information retrieved from VIES, Member States have quite some information which can help them to detect VAT fraud. However, for a long time it has been incredibly difficult to coordinate the exchange of data. That is why, in 2010, Eurofisc was established.

Eurofisc: a network for the swift exchange of targeted information

Eurofisc was established in 2010 in order to promote and facilitate multilateral cooperation in the fight against VAT fraud, with a special emphasis on carousel/Missing Trader Intra-Community (MTIC) fraud.[3] It is a network of tax officials in which fraud signals can be rapidly exchanged between Member States (see Figure 1).

Eurofisc proved to be a successful institution regarding the exchange of VAT data and the fight against VAT fraud. However, although Member States now had a lot of data to exchange in a well-organised manner, they did not have the right tools to analyse this data. This situation changed in 2019, when Transaction Network Analysis was created.

Transaction Network Analysis: automating the analysis of VAT information

After a positive pilot conducted by the Benelux countries, Member States decided that TNA could serve as an excellent tool to improve the way EU VAT data is collected and analysed. Although participation in TNA is voluntary, at the moment of writing all 27 Member States are participating in the network. According to the European Commission TNA does “not substantially change the ‘what’, but improve the ‘how’ by addressing the following points:

- automating the collection of targeted information, e.g. VIES;

- improving the detection by introducing advanced data analytics;

- being able to visualize suspicious networks without manual intervention. In the future Member States will be monitoring the whole chains with the same information being available to all participating Member States;

- improving Member States ability to share data and qualify traders identified by Eurofisc by making them less dependent upon manual uploads of spreadsheets, resulting in a more structured and fluid way of information exchange;

- improving the quality of information shared by enhancing IT facilities for collecting and sharing the information. That would allow Member States to better allocate resources on which cases to investigate.”[4]

Real-time reporting: the last step

Automation and improved coordination contributed to a more efficient and rapid exchange of VAT data between Member States. This all helps in the fight against VAT fraud. However, it does not solve the inherent problems of the current EU VAT system. In fact, it is estimated that the VAT gap for 2020 will be €164 billion, which would be a 17% increase from the VAT gap of 2018.[5] Therefore, it is essential, next to the already existing measures, to also implement real-time reporting. This would truly tackle VAT fraud by its core as it will no longer be possible to report any VAT, but it has to correspond to the invoice information reported to the tax authority. When implemented in a confidential way, the exchange of information can also be enhanced because Member States will be able to share data without revealing all company details. We explained that further here.

Conclusion

In short, information between Member States is shared via data reported to VIES and Intrastat, while coordinated via Eurofisc. TNA helps to automate the collection of this data and provides support in the analysis of the information. Over the last years, the exchange of information between Member States seems to have improved significantly which is great in the fight against VAT fraud. However, to truly tackle VAT fraud it seems inevitable to implement real-time reporting.

In case you want to learn more about how summitto’s real-time reporting system exactly works and how it benefits both the public and private sector you can visit our website. For questions, shoot us a message at info@summitto.com

[1] https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52017SC0428&rid=5

[2] https://www.avalara.com/vatlive/en/eu-vat-rules/eu-vat-returns/intrastat-reporting-thresholds.html

[3] https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L:2010:268:FULL&from=EN

[4] https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52017SC0428&rid=5